Strategy (MSTR) stock plunged about 7% on Thursday due to continued weakness in cryptocurrency Bitcoin (BTC-USD). MSTR has declined over 12% in the past month and is up just 4% year-to-date. Yesterday, Bitcoin fell below $109,000, marking a three-week low, ahead of the $22 billion end-of-month options expiry on Friday. Experts also believe that the decline in Bitcoin and other cryptocurrencies is due to growing concerns about a potential U.S. government shutdown.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MSTR Stock Under Pressure

Strategy, earlier known as MicroStrategy, claims to be the largest Bitcoin treasury company. It also offers artificial intelligence (AI)-powered enterprise analytics software. Strategy accumulates Bitcoin by using proceeds from equity and debt financings, as well as cash flows from its operations.

In the September 15-21 period, MSTR sold 173,834 shares of its 10.00% series A perpetual preferred STRF shares for $19.4 million in net proceeds. Strategy also sold 227,401 shares of its common stock for $80.6 million. The company used the proceeds from these offerings to purchase 850 BTC for $99.7 million in this timeframe. As of September 21, 2025, MSTR held 639,835 Bitcoin. MSTR stock reacted negatively to the news of additional Bitcoin purchase, as it was funded by an at-the-money (ATM) stock offering, yet again raising concerns about shareholder dilution.

MSTR is viewed as a leveraged bet on Bitcoin, as it generally rises more than BTC during bull runs and falls more than the largest cryptocurrency during downturns. The stock has declined more than the drop in Bitcoin since the Federal Reserve’s recent interest rate cut.

On Thursday, Bitcoin and MSTR critic Peter Schiff warned of a “brutal bear market” for Bitcoin treasury companies. He stated that while so many companies have been busy replicating Michael Saylor’s (founder and Chairman of Strategy) “harebrained” business strategy, few have noticed that MSTR stock is down 45% from its November 2024 high. “I’m not sure if any, including MSTR, will survive it,” cautioned Schiff.

Is MSTR Stock a Good Buy?

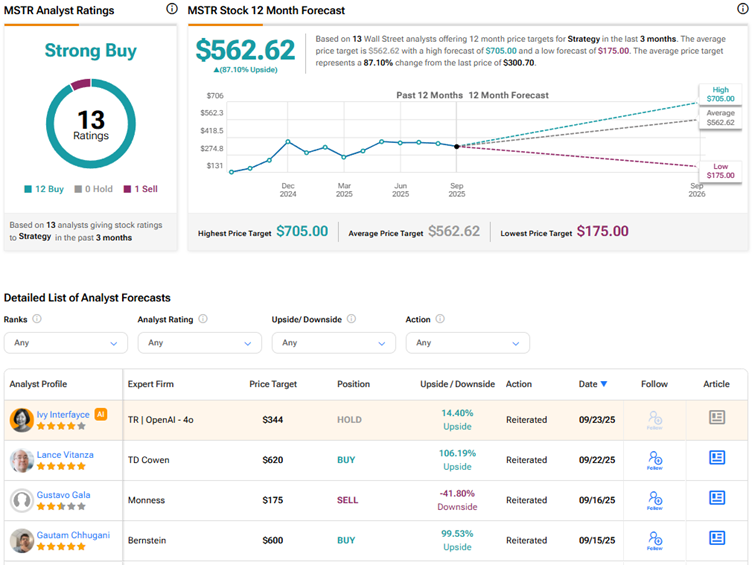

Currently, Wall Street has a Strong Buy consensus rating on Strategy stock based on 12 Buys and one Sell recommendation. The average MSTR stock price target of $562.62 indicates 87.1% upside potential from current levels.