Shares of Strategy (MSTR) have more than doubled over the past year as investors buy into the company’s large Bitcoin holdings and its steady accumulation strategy. As of Sept. 15, 2025, Strategy reported roughly 638,985 Bitcoin on its books. Despite the run, TipRanks’ A.I. analysis urges caution, citing uncertainty around profitability and the company’s heavy reliance on Bitcoin’s price moves.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks based on key performance metrics, giving investors a clear and concise snapshot of a stock’s potential.

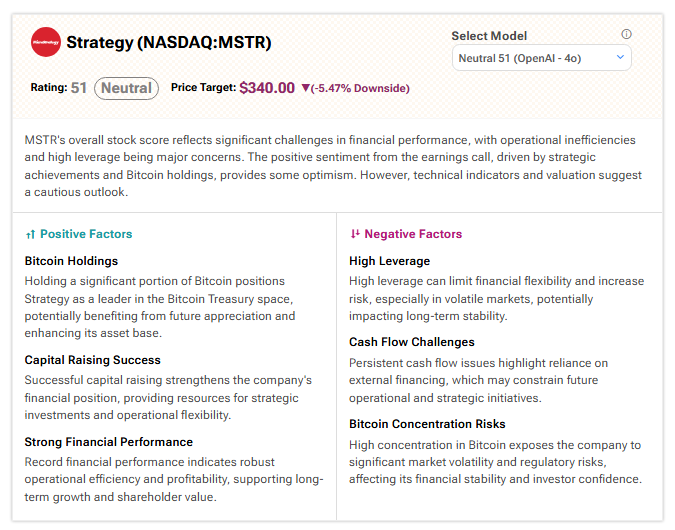

AI Analyst Has a Neutral Stance on MSTR Stock

According to TipRanks’ AI Stock Analysis, MSTR stock scores a Neutral rating with a price target of $340, which indicates a possible downside of 5.47% from current levels. The AI score is 51 out of 100, which reflects mixed fundamentals and ongoing financial challenges.

AI Analyst Weighs MSTR’s Strengths and Risks

The analysis points out both positive and negative factors that affect the company’s outlook. On the positive side, Strategy’s large Bitcoin holdings remain its biggest strength. The company is seen as a key player in the Bitcoin investment space and stands to gain if Bitcoin prices rise. It has also been able to raise funds successfully, which helps support its spending needs and daily operations.

Meanwhile, its recent Q2 financial results show steady performance, giving investors some confidence in its long-term outlook. The company posted EPS of $32.60 in Q2, boosted mainly by unrealized Bitcoin gains under the new accounting rules.

On the downside, the AI model highlights clear risks. High debt levels and reliance on outside financing limit flexibility. The company’s heavy concentration in Bitcoin also makes it far more volatile than a typical software firm. These factors are why TipRanks’ A.I. keeps a neutral view despite the rally.

Is MSTR Stock a Good Buy?

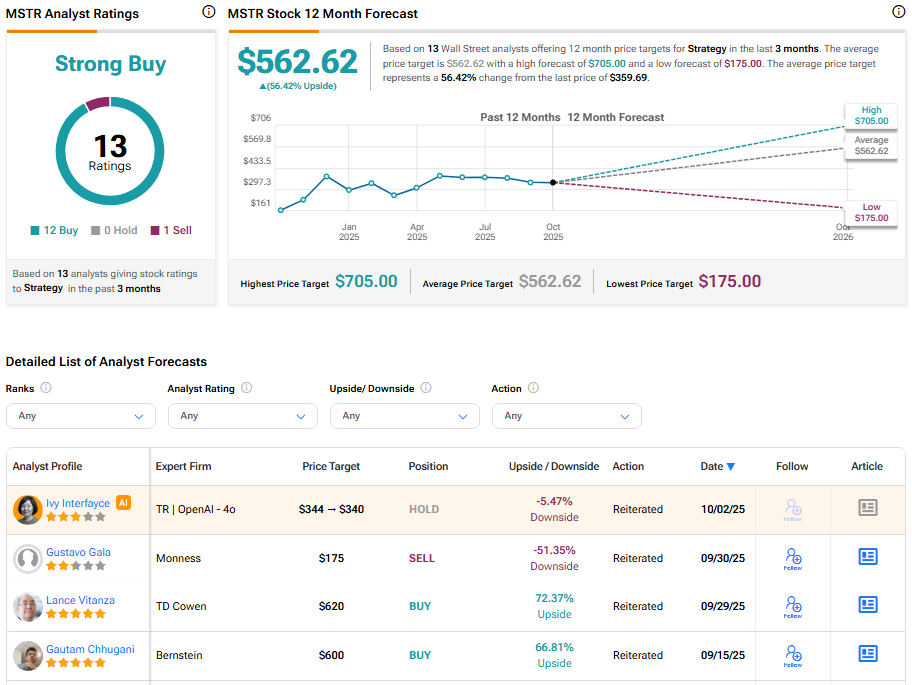

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on 12 Buys, zero Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average MSTR price target of $562.62 per share implies 56.42% upside potential.