Strategy has held firm through the Bitcoin crash without selling its holdings. The focus now is on whether that stability helps keep its S&P 500 bid on track.

Education

About Us

Working with TipRanks

Follow Us

Strategy Stock Is ‘Relatively Cheap’ after Bitcoin Crash as ‘S&P 500 Inclusion in December Still Exists’

Story Highlights

Strategy’s (MSTR) sharp selloff has reignited every familiar question about whether a corporate Bitcoin balance sheet can really survive deep drawdowns. This time, though, researchers at Matrixport say the company looks stable and still on track for a possible S&P 500 (SPX) inclusion in December.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The firm’s shares fell from a high of $474 to about $207 during the recent correction, but Matrixport argues that the market may be missing the bigger picture. The pressure, they say, sits mainly with investors who bought the stock at inflated NAV levels rather than with Strategy’s ability to meet debt obligations.

“In crypto, the shares now appear relatively cheap, and the possibility of S&P 500 inclusion in December still exists,” Matrixport wrote.

Matrixport Sees Limited Liquidation Risk

Matrixport’s note pushes back on fears that Strategy might need to dump Bitcoin during major selloffs. Analysts say a forced liquidation is not a “near-term risk,” even after the steep correction.

Instead, the real issue is NAV compression. Buyers who chased the stock when it was trading at a steep premium are now absorbing most of the pain as that premium normalizes.

Crypto market intelligence firm 10X Research also estimated a 70% chance that Strategy will make it into the index by year-end.

Strategy Earns Its First S&P Global Rating

Strategy received a “B-” credit rating from S&P Global Ratings. The grade sits in speculative territory but marks the first time a Bitcoin treasury company has been formally rated by the agency. Analysts say the rating creates a new benchmark for evaluating corporate crypto treasuries.

Smaller Crypto Treasuries Face New Funding Challenges

The selloff has been harder on smaller digital asset treasuries. Several firms saw their mNAV ratios slip below 1, which limits their ability to issue new shares and buy more crypto.

Those companies include BitMine (BMNR), Metaplanet (JP:3350), Sharplink Gaming (SBET), Upexi (UPXI) and DeFi Development Corp (DFDV). Market-wide declines in mNAV values have been building since June, and Standard Chartered data shows the trend is widespread.

Saylor Stays Confident in Extreme Drawdowns

Strategy’s executive chairman Michael Saylor responded to concerns directly. He told Fox Business the company is built to withstand the worst of Bitcoin’s volatility.

“The company is engineered to take an 80 to 90% drawdown and keep on ticking,” he said.

Strategy also announced one of its largest recent purchases. It bought 8,178 Bitcoin worth $835 million, a sharp increase from its pace of roughly 400 to 500 BTC per month.

It’s a Stress Test That Strategy Has Been Passing with Flying Colours

The correction is a reminder of how closely corporate Bitcoin equities follow the market’s extremes. But on this round, Strategy looks more stable than the price action suggests. Its balance sheet is intact, its index hopes remain alive and its Bitcoin buying has not slowed.

Whether the stock can reclaim its highs will depend on Bitcoin’s next move and whether investors trust the NAV premium again after such a sharp reset.

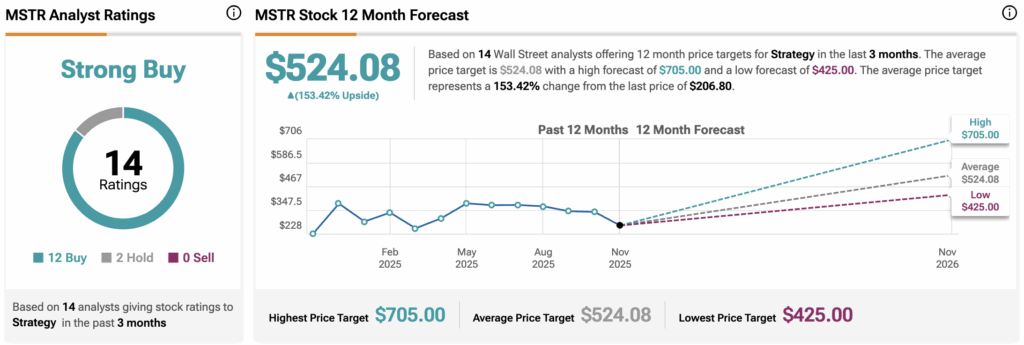

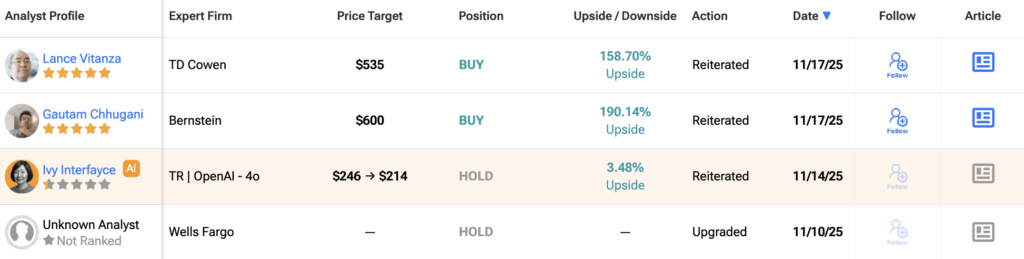

Is Strategy a Good Stock to Buy?

Strategy continues to draw strong backing from Wall Street. 14 analysts have issued ratings over the past three months, and the group leans heavily positive, with 12 Buy calls and 2 Hold ratings.

The average 12-month MSTR price target sits at $524.08, suggesting 153% upside from the latest price.

1