After spending a few weeks building up its cash reserves to roughly $2.2 billion, Strategy (MSTR) is back to its core mission: bitcoin-winter">accumulating as much Bitcoin as possible. A new SEC filing reveals that between December 22 and December 28, the firm bought 1,229 Bitcoin at an average price of $88,568.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This latest reload pushes the company’s total holdings to nearly 672,500 coins. This further cements its status as the largest corporate Bitcoin holder in the world.

How Did Strategy Fund this Investment?

The funding for this $109 million buy came from the company’s At-The-Market (ATM) offering program. Essentially, Strategy creates and sells new shares of its stock directly into the market and uses those proceeds to buy Bitcoin. While this dilutes existing shareholders, the company argues it is “accretive” because the amount of Bitcoin held per share actually goes up.

However, on Monday morning, investors reacted to the new supply of shares by pushing the stock down 1.2% to $156.91.

Strategy Is Chasing a 30% “BTC Yield”

The ultimate goal for 2025 has been what the company calls “BTC Yield”—a performance metric that tracks how effectively they are increasing their Bitcoin holdings relative to their total share count.

Currently, that yield stands at 26% for the year, and management is pushing to hit a 30% target by the end of December. Even with Bitcoin currently facing resistance near $87,000, Strategy is betting that acquiring more coins now will pay off massively if the market rallies toward $100,000 in early 2026

Key Takeaway

The bottom line is that Strategy is effectively a Bitcoin-buying machine that never stops. By selling stock to buy more coins even when the market is “sideways,” Michael Saylor is ensuring that the company’s fate is permanently tied to the success of Bitcoin. For investors, this makes MSTR a leveraged play on the cryptocurrency that currently owns over 3% of the total global supply.

Is Strategy a Good Stock to Buy?

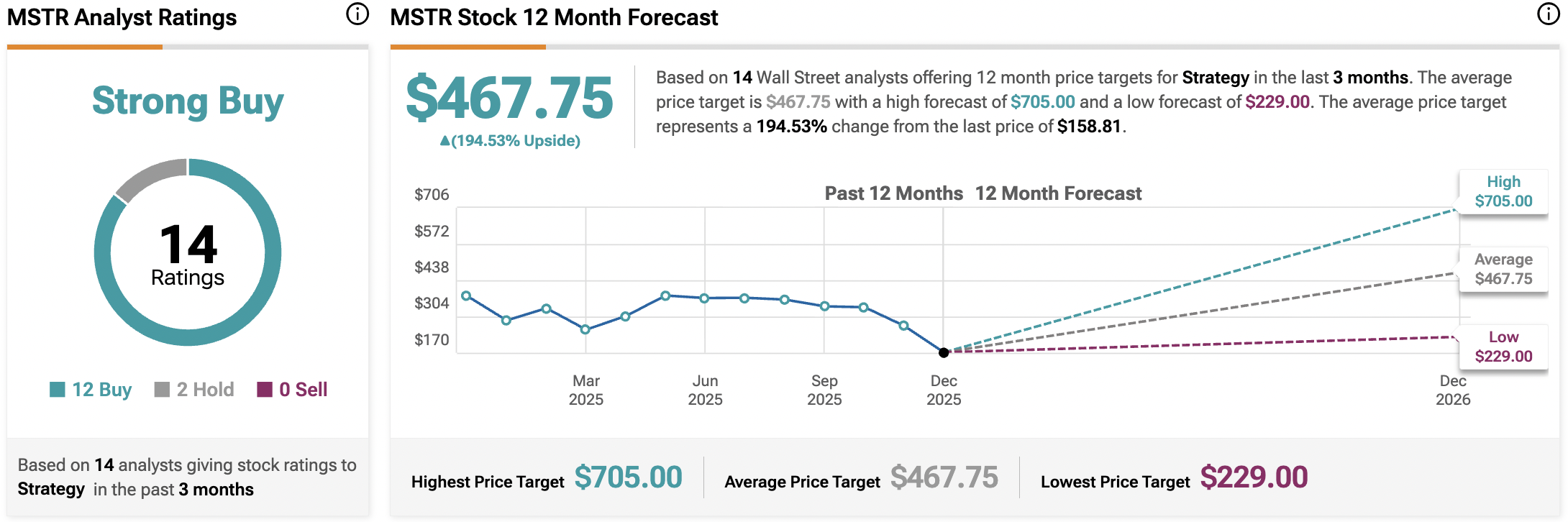

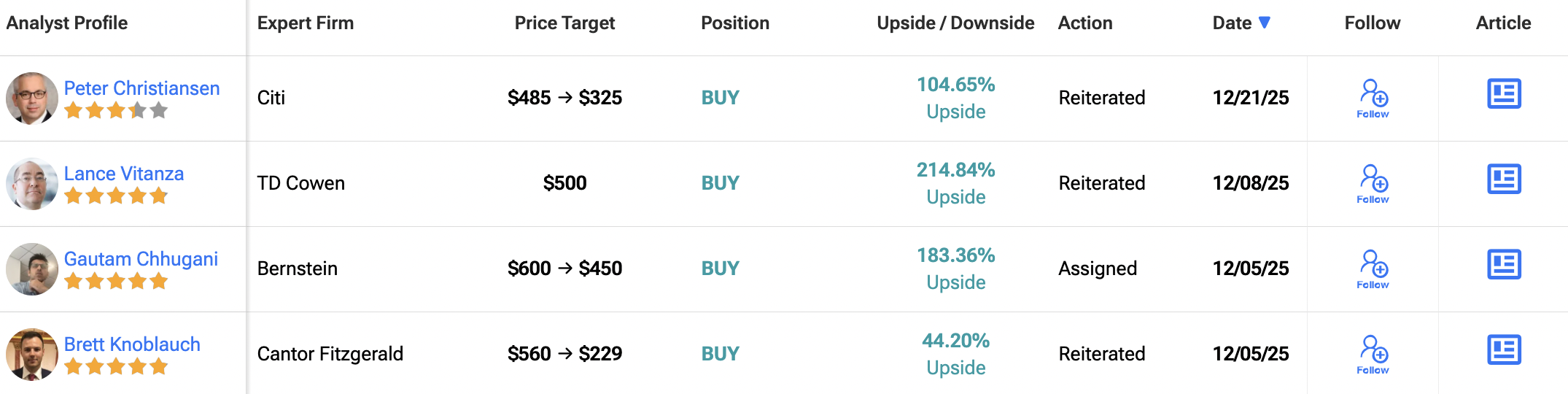

Turning to TipRanks, analyst data shows Wall Street remains firmly optimistic about Strategy (MSTR). In total, 14 analysts have weighed in over the past three months, and the consensus rating sits at Strong Buy. Out of these calls, 12 analysts call the stock a Buy, two say a Hold, and none recommend a Sell.

The average 12-month MSTR price target comes in at $467.75, which implies roughly 195% upside from the recent close.