Michael Saylor’s Bitcoin-hungry holding company, Strategy (MSTR), just posted eye-watering numbers — but for once, it didn’t buy the dip.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

In its latest SEC filing, Strategy revealed a $14.05 billion unrealized gain on its Bitcoin holdings for Q2 2025. That’s a staggering paper profit, even by Saylor’s standards. With 597,325 BTC sitting on its books, the company’s carrying value hit $64.36 billion by June 30, with a related deferred tax liability of $6.31 billion. But the headline isn’t just the size of the gain. It’s the silence of the buy button.

It’s a Break in Strategy’s Usual Rhythm

For months, Strategy has been a metronome in the market — buying Bitcoin every single week. This week broke that rhythm. Despite prices falling as low as $105,400, the company didn’t add to its holdings. That marks the first skipped purchase since April, when the firm also paused buying as Bitcoin dipped below $87,000.

Historically, these pauses have been short-lived. Back in April, Strategy came back two weeks later with a 3,459 BTC buy, shortly after scooping up a much larger 22,048 BTC in late March. This time, the market saw a bounce above $110,000 on July 3, but Strategy remained on the sidelines.

What gives?

A Strategic Pause or Tactical Caution?

There are a few possibilities here. One: Strategy simply needed to breathe. Even a Bitcoin maximalist has to manage cash flow, especially when previous buys have totaled billions.

Two: there’s a tax optimization angle. The firm’s $14 billion gain comes with a $4 billion deferred tax expense, and skipping a purchase could help manage timing and balance sheet optics heading into Q3.

Or three: Saylor is waiting for a better setup, not necessarily a better price. The strategy, after all, isn’t just about buying low. It’s about buying to signal strength, to show conviction, and to force market narrative. A purchase now, as BTC hovers above $108,000, might be less about timing and more about messaging. And the message might be: we’ve already won this round.

Strategy Has $64B in Bitcoin and Counting

With just under 600,000 BTC, Strategy is the biggest corporate whale in the world. The unrealized gains show just how deep in the green the firm is, especially compared to early 2024, when BTC was still struggling to reclaim $70,000.

Bloomberg analysts had projected $13 billion in unrealized gains for Q2. Strategy beat that by over a billion dollars. It’s a quiet flex, not just in balance sheet strength, but in the discipline to pause when everyone expects you to press “Buy.”

Saylor has been nothing if not consistent in his Bitcoin conviction. A skipped week does not signal a shift in long-term strategy. If anything, it invites even more attention to what will trigger the next purchase.

Until then, Strategy’s $14 billion win remains a masterclass in conviction, timing, and the slow, patient accumulation that has now become its brand.

Is MicroStrategy a Good Stock to Buy?

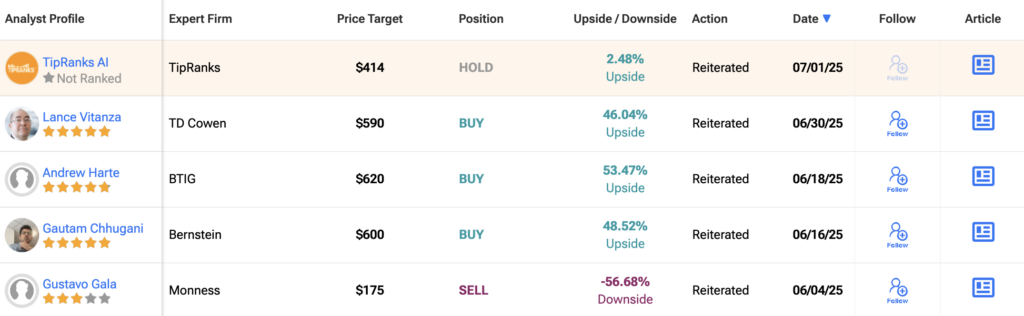

According to TipRanks data, Strategy (formerly known as MicroStrategy) is currently rated a Strong Buy based on 12 analyst ratings issued over the past three months. Out of the 12, a notable 11 analysts have issued a Buy recommendation, with just one suggesting Sell and none calling for Hold. The average 12-month MSTR price target sits at $533.50, implying a potential upside of 32.06% from the last close of $403.99.