Strategy (MSTR), the largest public company with Bitcoin holdings, announced that it sold 847,000 shares between May 19 and May 25 in order to raise $348.7 million through its ongoing stock offering. The company then used the funds to buy 4,020 more Bitcoins to bring its total holdings to 580,250 BTC. It is worth noting that Strategy has been steadily buying Bitcoin since 2020 and has become a popular way for investors to get exposure to Bitcoin without directly owning it.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Interestingly, even though Bitcoin recently hit a new record high above $110,000, Strategy’s stock hasn’t kept up. While Bitcoin keeps rising, MSTR is still well below its all-time high of $543. As a result, this gap is raising some concerns. Indeed, Markus Thielen from 10x Research recommended a bearish trade on MSTR by buying a $370 put and selling a $300 put (expiring June 27), which will reach its maximum profit if the stock drops to $300 or lower. Thielen said this strategy reflects the growing disconnect between Bitcoin’s strength and Strategy’s slower stock performance.

Thielen believes that this put spread can help hedge against a drop in Bitcoin or Strategy. He also noted that a similar gap between MSTR and Bitcoin happened before Bitcoin’s last major top in 2021. While that doesn’t mean Bitcoin’s rally is over, it does suggest that some big investors are becoming more cautious. Thielen said, “Bitcoin is breaking records, but Strategy is stalling—and that divergence matters,” adding that this could be a turning point for investors.

Is MSTR a Good Stock to Buy?

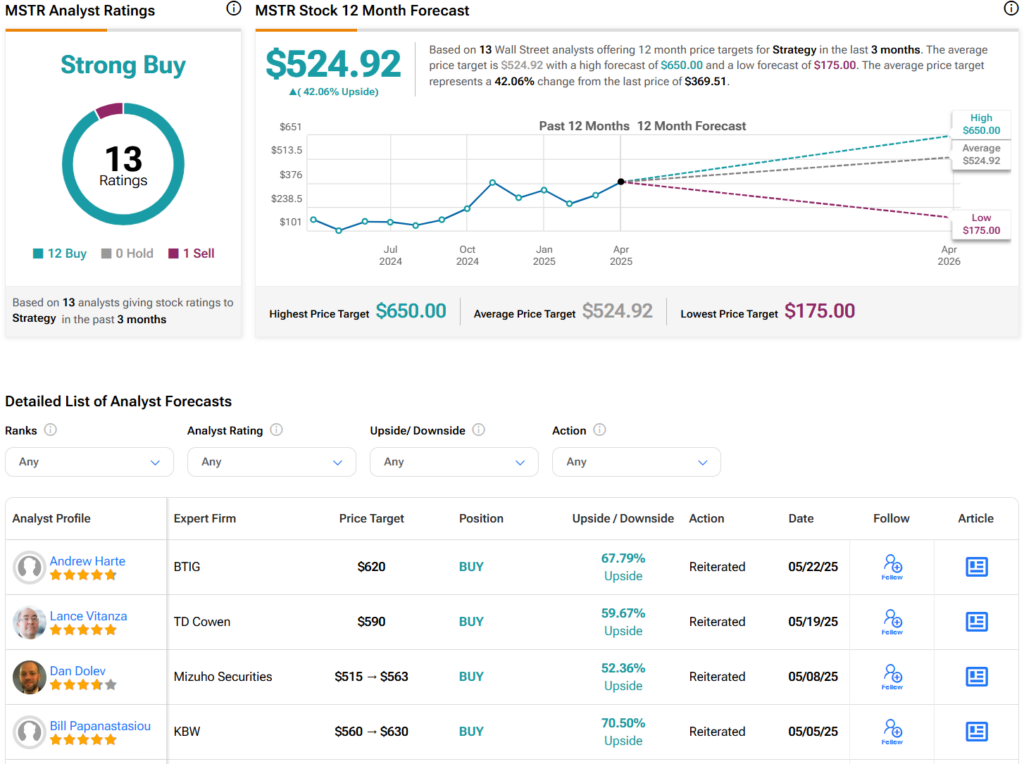

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on 12 Buys, zero Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average MSTR price target of $524.92 per share implies 42% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue