Concerns about President Trump’s new tariffs have caused U.S. stock markets to drop sharply, and some experts believe there’s more downside ahead. Indeed, Larry Fink, the CEO of investment managing firm BlackRock (BLK), said on Monday that stocks could fall another 20% and that the U.S. might already be in a recession. Still, he views the sell-off as a long-term buying opportunity, not a reason to panic. Fink also warned that inflation could turn out to be worse than most investors expect.

As a result, many on Wall Street are now rethinking their earnings expectations. Adam Parker, CEO of Trivariate Research and a former top strategist at Morgan Stanley, said earnings growth for the S&P 500 (SPX) has likely been wiped out by the tariffs. The current estimate of $268.70 in earnings per share for 2025 is now seen as too high. Therefore, he believes that EPS will only grow by about 1% this year to $250 and that 2026 earnings might be flat to 2027.

In addition, Wedbush analyst Dan Ives added that it is extremely hard to predict company profits right now due to so much uncertainty. Meanwhile, Goldman Sachs raised its odds of a U.S. recession in the next year to 45%, up from 35% last week. Economist Judy Shelton told Yahoo Finance that markets might be overreacting, but it’s too early to tell. For now, the full impact of the tariffs on inflation, growth, and earnings is still playing out.

Is BLK a Good Stock to Buy Now?

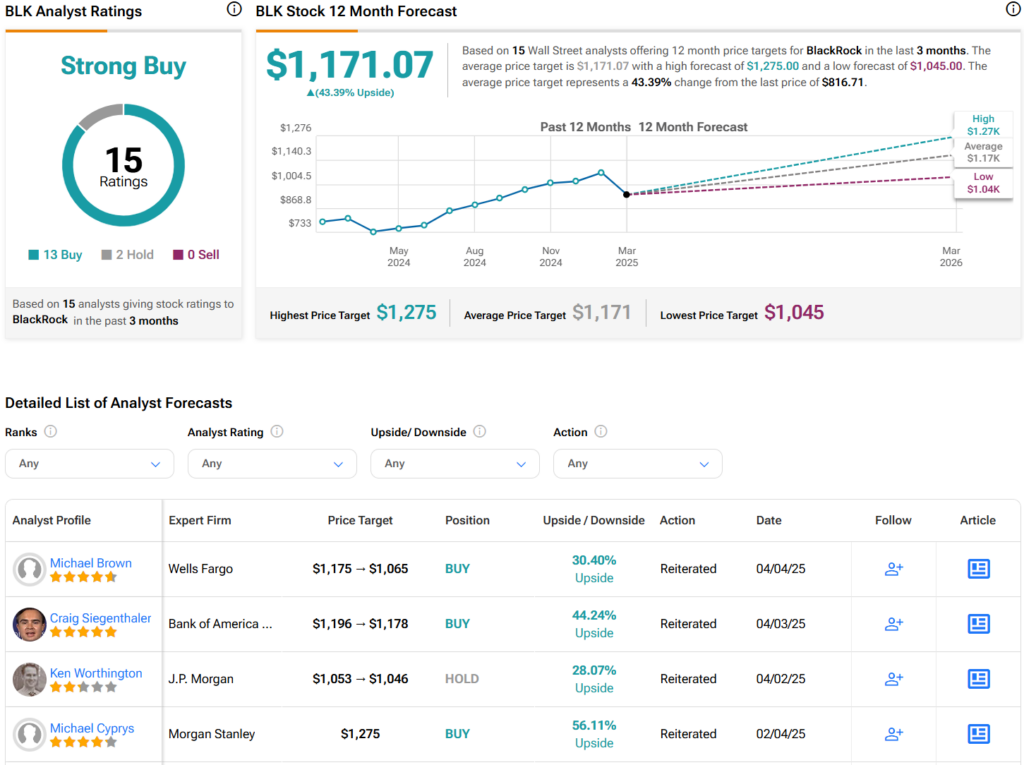

Turning to Wall Street, analysts have a Strong Buy consensus rating on BLK stock based on 13 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average BLK price target of $1,171.07 per share implies 43.4% upside potential.