Shares of Stellantis (STLA) fell in pre-market trading after the company’s net profit in the first half of the year dropped steeply. The company, which owns car brands like Jeep, Dodge, and Peugeot, reported a net profit of €5.6 billion, down 48% year-over-year, primarily because of lower volume and mix, as well as challenges from foreign exchange and restructuring costs. The company’s adjusted earnings in the first half of the year came in at €2.36 per share, a decline of 35% year-over-year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales declined by 14% year-over-year, with revenue hitting €85 billion. Furthermore, the company has planned 20 new product launches this year and it has already started production of 10 such models in the first six months of the year.

Why Did STLA’s Profits Drop in H1?

The company cited reduced volumes, temporary production gaps, and lower market share, particularly in North America, as reasons for the steep decline in profits. Production gaps occur when there is a discrepancy between actual industrial output and potential production.

Furthermore, Stellantis’s adjusted operating income fell by €5.7 billion year-over-year to €8.5 billion in the first half of the year, primarily “due to decreases in North America.”

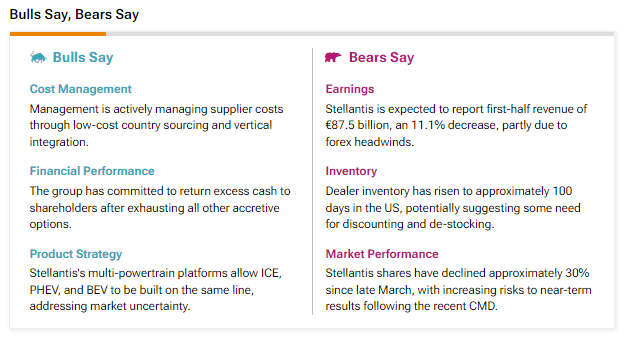

According to the TipRanks “Bulls Say, Bears Say,” analysts bearish on STLA stock had flagged its rising inventory stating “dealer inventory has risen to approximately 100 days in the US, potentially suggesting some need for discounting and de-stocking.”

However, the company stated that its management was actively trying to “address operational challenges, including North American share and inventory performance.”

STLA’s FY24 Outlook and Stock Buyback

Looking forward, management reiterated its FY24 outlook and expects the adjusted operating income margin to be in double digits with positive industrial free cash flows.

Stellantis returned €6.7 billion in capital in the first half of the year, driven by its accelerated €3 billion share buyback program, and is committed to returning at least €7.7 billion by the end of this year.

Is STLA a Good Stock to Buy?

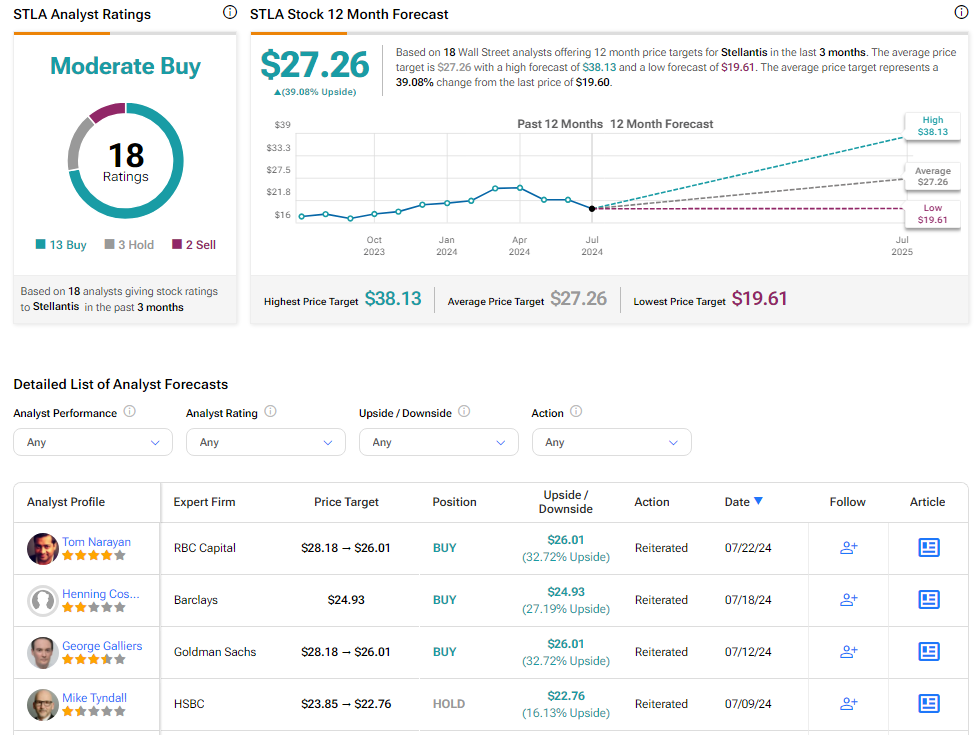

Analysts remain cautiously optimistic about STLA stock, with a Moderate Buy consensus rating based on 13 Buys, three Holds, and two Sells. Over the past year, STLA has increased by more than 10%, and the average STLA price target of $27.26 implies an upside potential of 39.1% from current levels. These analysts’ ratings are likely to change following STLA’s results today.