Shares in Chrysler-maker Stellantis (STLA) reversed badly today as a warning of one-off charges overshadowed accelerating Q3 revenues.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

December Bookings

The automaker, whose other brands include Jeep, Dodge and Fiat, said it expected to book charges in the second half of the year through to December. This was a result of changes to its strategic and product plans as well as a review of its warranty estimation process.

It did not provide further details.

Despite this, Stellantis reaffirmed its financial guidance for the second half of the year with continued improvement in net revenues and free cash flows compared to the first half of the year. However, Stellantis said that this guidance assumed no disruptions or shortages in the current supply chain scenario.

That comes as the global auto industry is grappling with a deepening semiconductor supply crunch stemming from U.S.-China trade war-related issues at Dutch firm Nexperia.

Overall, the company said that the estimated impact from U.S. tariff policies in place as of October 30 was around 1 billion euros for 2025, compared to a previous estimate of between 1 and 1.5 billion euros. It was speaking before the trade meeting between President Trump of the U.S. and Xi of China today.

Revenues Race

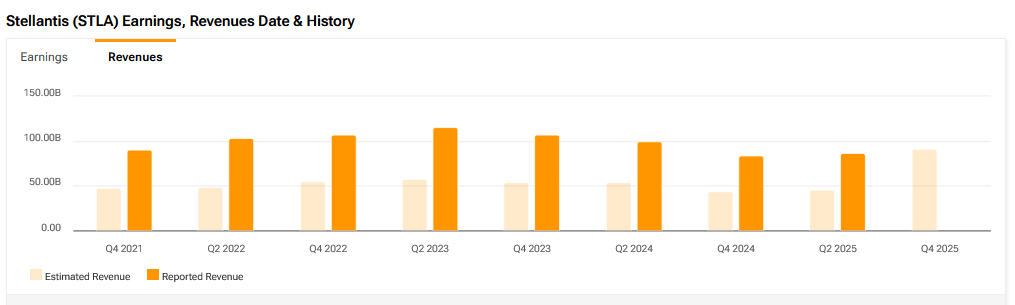

Stellantis’ net revenues for the July to September quarter beat analyst forecasts to come in at $43.2 billion. That is up 13% year-on-year and was mainly driven by growth in its North American and European markets. Revenues in South America were down.

Global sales increased by 4% with the U.S. seeing a 6% lift. Demand in the States, said Stellantis, was seen across its Jeep, Ram, Chrysler, and Dodge brands. It took its monthly market share to 8.7% in September, the highest in 15 months.

The figures show that new chief executive Antonio Filosa’s turnaround plan is on track. He has battled to reverse a sales decline in the U.S. and cut excess vehicle inventories at dealers in North America.

He has brought back popular models such as the Jeep Cherokee SUV, and is refocusing towards hybrid and gasoline vehicles after a previous push towards electrification.

Earlier this month, Stellantis also said it would invest $13 billion to boost production in the U.S. It marked the largest U.S. investment in the firm’s 100-year history, which the company said will include the launch of five new vehicles and the creation of more than 5,000 jobs.

Is STLA a Good Stock to Buy Now?

On TipRanks, STLA has a Hold consensus based on 4 Buy, 7 Hold and 1 Sell ratings. Its highest price target is $14.52. STLA stock’s consensus price target is $11.22 implying a 10.92% upside.