Stellantis NV (STLA) is preparing to invest about $10 billion in the U.S. as it works to regain ground in its most profitable market. The plan includes new funding for factories in Illinois and Michigan, along with hiring efforts and new models under its key American brands.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company may soon announce about $5 billion in new spending on top of a similar amount set earlier this year. These funds are expected to help reopen plants, expand local production, and support long-term projects for Dodge and Chrysler. The move follows several years of cost-cutting that shifted much of Stellantis’ production to Mexico. In the meantime, STLA shares have climbed 3.17% in Friday’s trading, closing at $10.73.

New CEO Refocuses on the U.S. Market

The strategy is led by the new Chief Executive Officer, Antonio Filosa, who assumed the top role in May. Under former CEO Carlos Tavares, Stellantis had concentrated on Europe and lower-cost markets, while U.S. sales declined. Now, Filosa is steering the company back to its home market roots.

As part of the reset, Stellantis plans to bring back dropped models such as the Jeep Cherokee and 8-cylinder Ram trucks. These vehicles once led sales but were phased out under the previous strategy. The company is also reviewing its premium brands, Maserati and Alfa Romeo, with guidance from consulting firm McKinsey & Co.

Balancing Politics and Global Reach

The new investments arrive as carmakers adapt to shifting U.S. trade policy. President Donald Trump’s tariffs on vehicles from Mexico have raised costs across the industry. Stellantis has been lobbying for relief as it builds Ram pickups south of the border. Increasing production at U.S. plants could help offset that pressure.

Chairman John Elkann has also pledged to bring new jobs back to Belvidere, Illinois, where Stellantis will reopen an idled factory and hire about 1,500 workers. That step could help ease tensions with the United Auto Workers union and align with the administration’s focus on domestic manufacturing.

The company’s U.S. push mirrors moves by other automakers and manufacturers investing heavily in the country. Hyundai Motor Group (HYMTF) recently lifted its U.S. commitment to $26 billion through 2028, while several large pharmaceutical companies have announced similar plans.

However, Stellantis still faces challenges abroad. In Europe, weak demand has led to temporary shutdowns at several plants, and unions are concerned about job losses. Filosa is set to meet with Italian labor groups later this month to address those concerns.

Looking Ahead

Stellantis is expected to outline its full strategy next year during a capital markets event. For now, investors are watching whether stronger U.S. sales can lift results. The company posted a small gain in deliveries last quarter, and the new plan could help extend that progress.

By turning its attention back to the U.S., Stellantis aims to rebuild its core brands, strengthen its balance sheet, and restore momentum in a key market that once defined its success.

Is Stellantis Stock a Strong Buy?

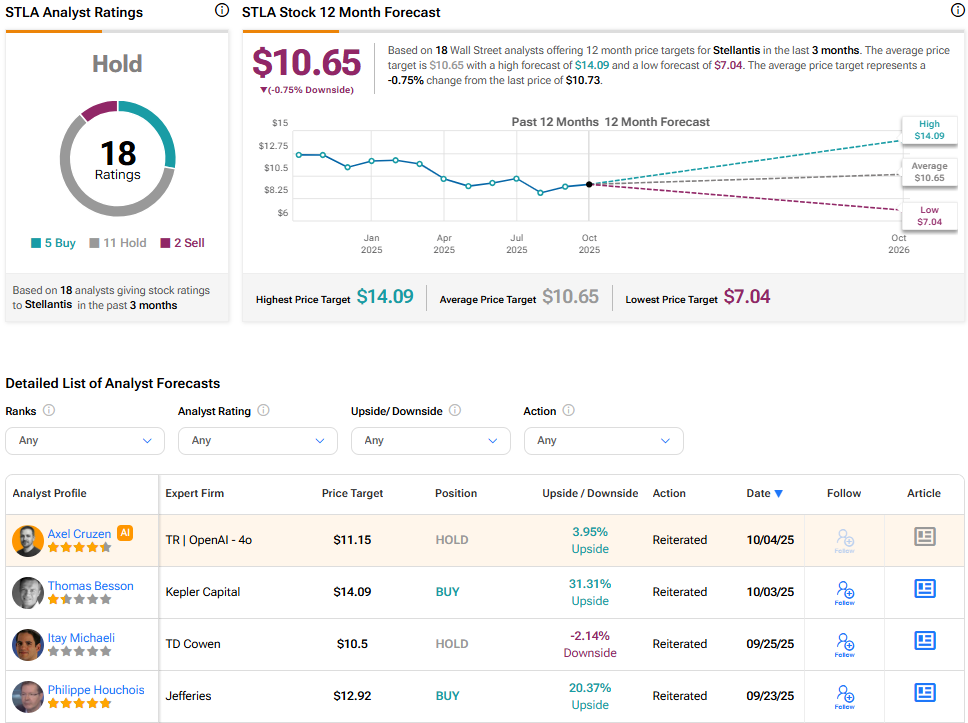

The short answer is no. Stellantis boasts a Hold consensus rating among the Street’s analysts. The average STLA stock price target is $10.65, implying a 0.75% downside from the current price.