Steel Dynamics (STLD) has issued a disappointing outlook for its third-quarter 2024 adjusted earnings. The company projects Q3 earnings per share in the range of $1.94 to $1.98, which is below the consensus estimate of $2.07. Also, it expects EPS to decline 43.5% year-over-year and 27.9% sequentially from the midpoint of the guided range. This decrease is mainly due to a reduction in average realized pricing across its key segments.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The company is scheduled to release its third-quarter financial results after the market closes on October 16. Importantly, investors would closely watch STLD’s earnings report for further insights into pricing challenges and the company’s strategies to navigate them.

Key Segments Impacting STLD’s Q3 Performance

The company pointed out that challenges in its Steel, Steel Fabrication, and Metals Recycling segments are expected to affect Q3 results. Let’s take a closer look at these issues.

- Steel Operations: STLD’s weaker-than-expected outlook is primarily attributed to challenges in its Steel Operations segment. The primary issue is lower average realized pricing in its flat-rolled operations, which is affected by contractually based pricing linked to lagging indices.

- Steel Fabrication Operations: This segment’s earnings are expected to decline moderately from the second quarter due to a slight decrease in average realized pricing. Nevertheless, the company remains optimistic about the unit’s order backlog, which extends into the first quarter of 2025 at favorable pricing levels.

- Metals Recycling Operations: Steel Dynamics expects earnings from its Metals Recycling Operations to remain stable sequentially, with steady volumes offsetting slightly lower realized pricing.

Overall, Steel Dynamics’ outlook for the third quarter reflects the ongoing challenges in the steel industry, primarily driven by pricing pressures.

Is Steel Dynamics a Good Stock to Buy?

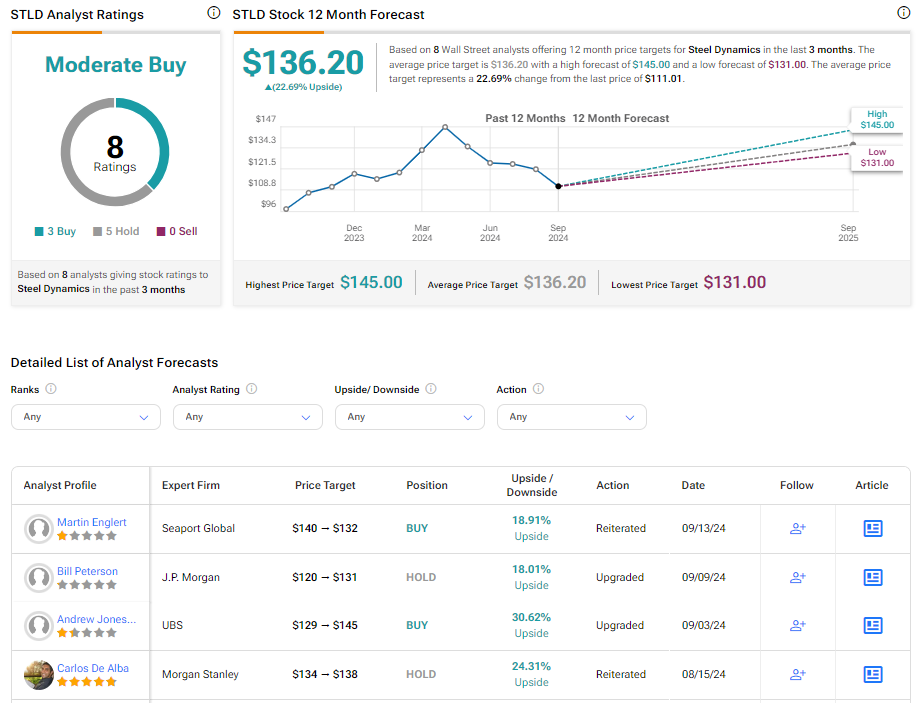

Turning to Wall Street, STLD has a Moderate Buy consensus rating based on three Buys and five Holds assigned in the last three months. At $136.20, the average Steel Dynamics stock price target implies 22.69% upside potential. Shares of the company have declined over 20% in the past six months.