Tesla (NASDAQ:TSLA) has spent the past year reminding investors that it is far more than an automaker, steadily pushing deeper into AI with advances in Full Self-Driving software, data-driven autonomy, and its long-term humanoid robot ambitions. Those initiatives continue to shape the company’s narrative and valuation, positioning Tesla at the crossroads of transportation and artificial intelligence.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Yet, for all the excitement around AI, the company’s financial heartbeat still lies in its vehicle business. Car sales remain Tesla’s bread and butter, anchoring revenue, margins, and market sentiment – which is why the attention quickly shifts back to the company’s Q4 deliveries report.

In the quarter, deliveries dropped by 16% versus the year-ago period, coming in at 418,227, below Wall Street’s forecast of 423,000. The miss was compounded by news that rival BYD overtook Tesla as the world’s biggest EV seller, marking the Chinese company’s first-ever year at the top of global EV sales.

Tesla’s lackluster numbers follow a trend established in the first and second quarters of last year, when vehicle sales took a sharp hit. That trend was reversed in Q3, but the bump was largely attributed to the expiration of the electric vehicle tax credit – something Q4’s numbers appeared to confirm.

Yet, Wedbush’s Daniel Ives, an analyst ranked among the top 5% on Wall Street, says the haul came in “much better than the whisper numbers” of ~410,000. Ives says the company is navigating a “more difficult demand environment” following the end of the EV tax credit and points to Europe as still representing a challenge for the Elon Musk-led firm.

“Europe remains a continuous headwind for TSLA with the company still having difficulty obtaining regulatory approval for its FSD tech with sales in the region waiting to rebound once FSD gets the go-ahead from regulators which we believe will happen in 1H26,” the 5-star analyst explained.

Meanwhile, sales in smaller and emerging markets are beginning to post growth rates that exceed expectations, which Ives believes is helping offset declines in major regions such as China and Europe, as Tesla increasingly targets niche markets to “drive further growth over time.”

The company also delivered a solid performance in its energy segment, reporting 14.2 GWh of storage deployments, above the Street’s forecast of 13.4 GWh, and reaching 46.7 GWh throughout 2025 compared with analysts’ expectations of 45.9 GWh. This was driven by strong growth in Megapack and Powerwall deployments, as the company benefits from “rising global demand” for grid-scale energy storage.

Ultimately, Ives thinks this will be seen as a “step in the right direction for the Tesla story heading into 2026.”

As full-scale volume production ramps across its autonomous and robotics roadmap, Ives believes Tesla has the potential to reach a $2 trillion market cap over the next year, with a bull case of $3 trillion by the end of 2026.

The analyst has a “bull case scenario” price target of $800 for the stock over the next 12 to 18 months, although for now his base case remains a Street-high $600, suggesting the shares could rise 37% over the coming months. Hardly needs adding, but Ives’ rating stays an Outperform (i.e., Buy). (To watch Ives’ track record, click here)

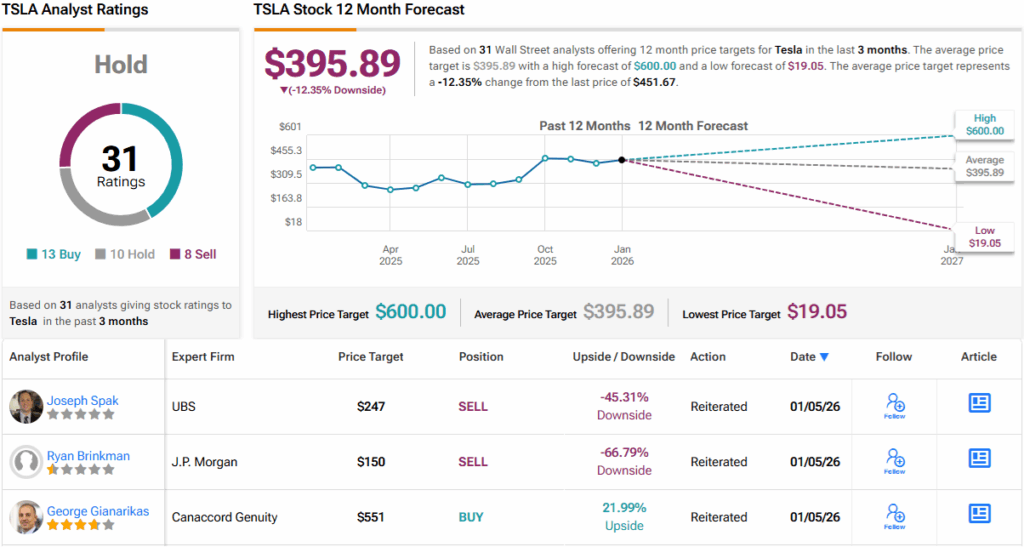

Ives’ bullish take gets the support of 12 other analysts, yet with an additional 10 Holds and 8 Sells, the stock only claims a Hold (i.e., Neutral) consensus rating. The average price target clocks in at $395.89, implying the stock has overshot by 12%. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.