Li Auto (LI) received a tempered outlook following its weaker-than-expected Q3 earnings. Bernstein SocGen Group analyst Eunice Lee lowered the price target to $20 from $25 while maintaining a Hold rating.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Li Auto Sets Ambitious Goals, But Analyst Cautions on Timeline

Lee noted that at the Q3 earnings call, Li Auto’s CEO, Li Xiang, disclosed an ambitious 10-year plan, addressing current headwinds and improving its organization, products, and technology.

The plan includes a return to an entrepreneurial model, focusing on user value and efficiency instead of short-term results. On the product side, the company aims to develop embodied AI, or vehicles as physical-world robots, powered by in-house chips and advanced operating systems.

While Lee believes management’s vision is “clear and inspiring,” she cautioned that execution is years away from reality. She added that to regain investor trust, Li Auto must show concrete progress in the next 12–18 months, such as higher deliveries, earnings growth, and positive cash flow.

Li Auto Prepares Major EV Upgrade

The company is preparing a major upgrade to its L-series extended-range EVs (EREVs) next year, integrating its in-house M100 chips. Li Auto also plans to speed up overseas expansion, signaling confidence in its technology and product pipeline.

Despite these efforts, Lee noted that uncertainty remains over whether these initiatives will be enough to drive near-term momentum. Thus, for now, the analyst remains cautious and maintains a Hold rating on Li Auto stock.

Is Li Auto Stock a Good Buy?

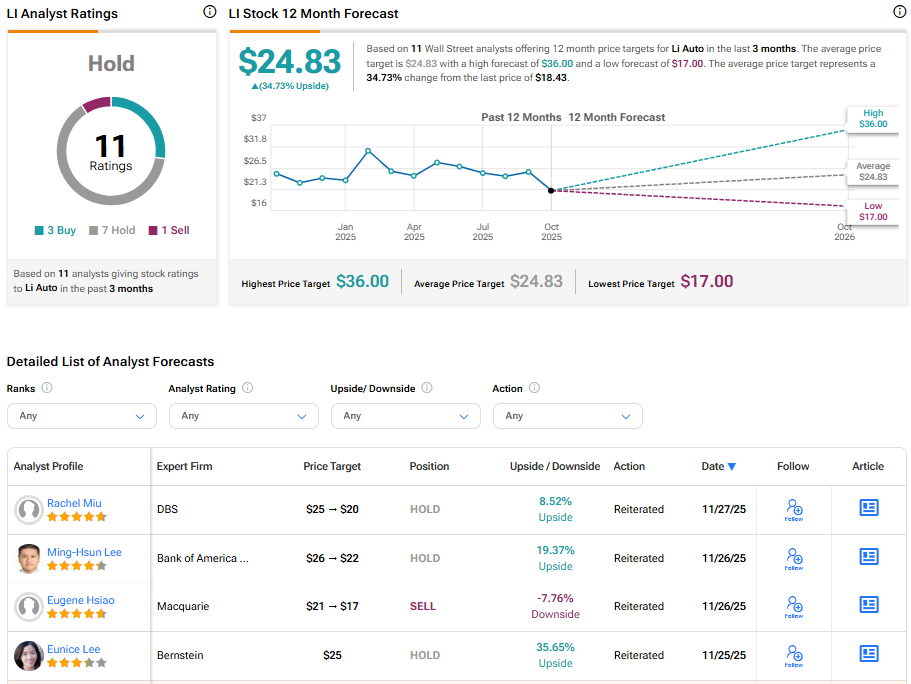

Wall Street has a Hold consensus rating on Li Auto stock based on three Buys, seven Holds, and one Sell recommendation, as indicated by the graphic below. The average LI stock price target of $24.83 indicates 34.73% upside potential from current levels.