Shares of The Star Entertainment Group Limited (AU:SGR) hit a historic low today after the company revealed more financial struggles in its latest update on cash and liquidity. The company reported its available cash balance of $79 million as of December 31, 2024, reflecting a decrease from the $149 million reported on September 30, 2024. Following the update, SGR shares fell by 33.3% on Thursday. In 2024, the stock has shed approximately 64% of its value, driven by huge losses reported in FY24 along with regulatory troubles.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Star Entertainment Group is a gambling and hospitality company operating major properties like The Star Sydney, The Star Gold Coast, and Treasury Brisbane.

Star Entertainment Faces Cash Flow Pressure

According to its update, the company has burnt through AU$107mn of cash in the three months to December. Star stated that the reduced cash balance indicates critical capital expenses, notable outlays such as upfront fees for securing a new loan, the initial payment of a $15 million fine levied by NSW gaming regulators, and higher costs from the ongoing transformation efforts.

The company’s financial instability stems from substantial penalties and the suspension of its license to independently manage its flagship Sydney casino, following compliance violations.

Meanwhile, Star landed the first $100 million tranche of a new loan facility in December. However, it is facing challenges in securing a second $100 million tranche due to its ongoing financial difficulties. The company is also exploring other potential options.

Jefferies Weighs in on SGR’s Financial Update

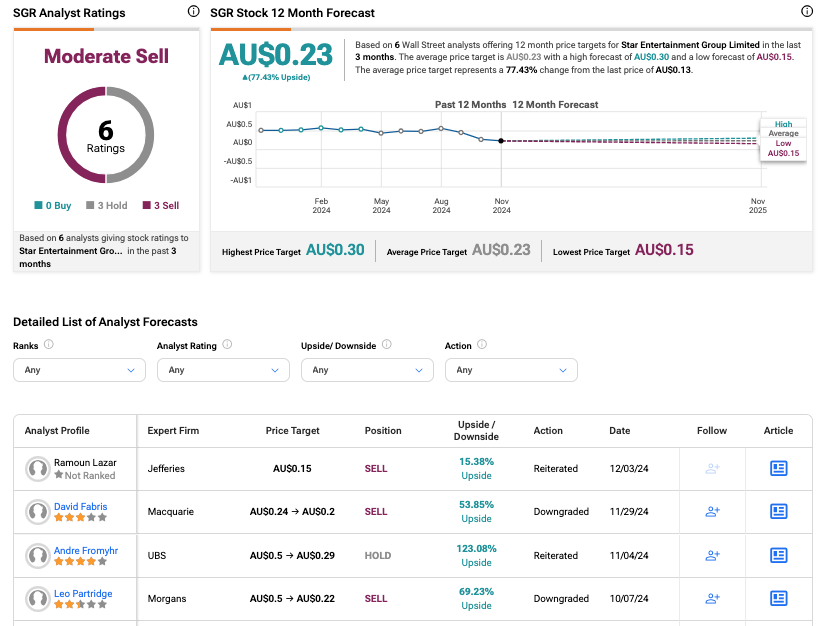

After the company’s latest update, Jefferies analysts expressed a grim outlook for Star Entertainment. The analysts see no short-term earnings recovery and difficulties in cost-cutting due to ongoing investment in rectification initiatives. They also emphasized that the company’s balance sheet challenges are significant and cannot be overlooked. Jefferies has a Sell rating on SGR stock.

Is Star Entertainment a Buy or Sell?

As per the consensus among analysts on TipRanks, SGR stock has been assigned a Moderate Sell rating. This is based on three Hold and three Sell recommendations. The Star Entertainment share price target is AU$0.23, which is 77.43% above the current level.