The race to own the future of digital money is accelerating in 2026. Standard Chartered (SCBFF) is reportedly working on a new service called a prime brokerage for crypto. This would act as a one-stop shop for big funds and institutions that want to trade assets like Bitcoin (BTC-USD) but need a safe, professional way to do it. The project, known as Project37C, is being built inside the bank’s venture capital arm, SC Ventures. This move shows that the London-based bank wants to be the main bridge between traditional finance and the new world of digital assets.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Standard Chartered Uses a Smart Way to Grow Fast

Standard Chartered is being very clever about how it builds this new business. By housing it inside SC Ventures instead of the main bank, they can avoid some very tough rules. Usually, big banks have to keep a massive amount of cash on hand if they hold Bitcoin, which makes it very expensive to run. Because this new branch is a venture unit, it doesn’t have to follow those same heavy Basel III rules. This allows the bank to offer market access and trading tools much faster and more cheaply than its rivals.

Other Wall Street Banks Become Crypto-Friendly

Standard Chartered isn’t alone in this push. Ever since the U.S. government became more friendly toward crypto last year, the biggest banks in the world have been rushing in. JPMorgan (JPM) is thinking about opening its own crypto trading desk, and Morgan Stanley (MS) is already launching new crypto funds. A big reason for this is the $140 billion that has flowed into Bitcoin ETFs over the last two years. Standard Chartered already lets big clients trade Bitcoin and Ether (ETH-USD), but this new brokerage will add extra services like lending and better risk management.

The bottom line is that this new project is part of a larger trend to make crypto trading look more like the regular stock market. Other big companies like Ripple (XRP-USD) have also been buying up prime brokers to help professionalize the industry. These moves are helping to turn crypto from a risky experiment into a standard part of global finance.

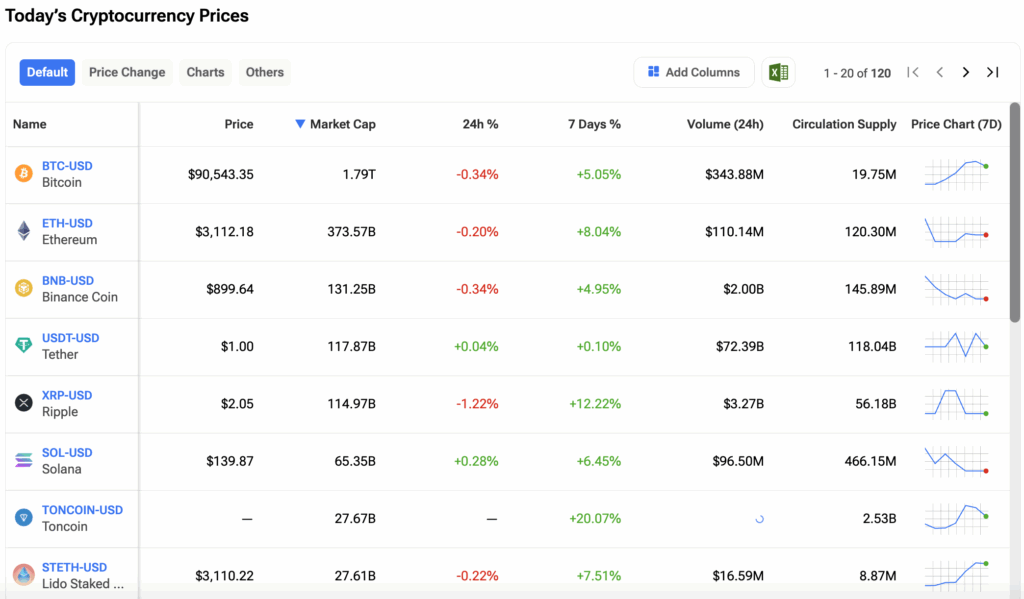

Investors can track the prices of their favorite cryptos on the TipRanks Cryptocurrency Center. Click on the image below to find out more.