STAG Industrial (NYSE:STAG) has historically paid a robust monthly dividend, providing investors with a reliable stream of income. That said, the stock is hardly attractive other than for conservative income investors. While the company’s rock-solid property portfolio remains well-positioned to keep producing reliable cash flows, I expect dividend increases to remain marginal, potentially underperforming inflation. Thus, I believe that the stock is suitable only for conservative income investors. I am neutral on STAG.

STAG’s Property Portfolio Remains Well-Positioned

STAG’s portfolio appears well-positioned to keep producing robust cash flows, in my view. While STAG’s multi-year lease profile somewhat hampers its overall growth prospects, it provides notable visibility to rent collection. Combined with the mission-critical nature of these properties, STAG is poised to keep growing slowly but surely.

To give you an overview, STAG’s portfolio comprises 569 industrial properties located in 41 states. More specifically, the property mix leans toward warehouses and distribution centers, with 493 buildings. The remaining are 70 light manufacturing buildings, one flex/office building, and five Value Add Portfolio buildings. This last category basically refers to sub-optimal or to-be-renovated properties.

STAG’s property portfolio has historically produced predictable cash flows and shown solid resilience, even during unfavorable market periods. To illustrate, even with occupancy declining by about 0.7% to 98.4% at the end of 2023 from 99.1% at the end of 2022, it still remains at an exceptional level. This was the case in 2020 and 2021 during the pandemic, with occupancy coming in at 97.7% and 97.1% in each period, respectively.

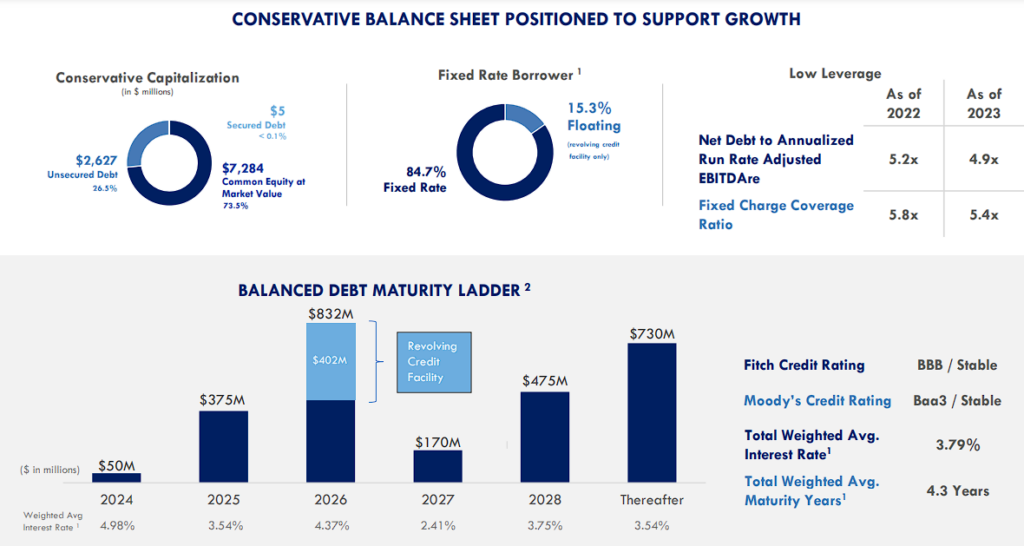

It makes sense, as warehouses and distribution centers are an integral component of any company’s supply chain dynamics. For this reason, it’s common to see STAG’s lessors try to secure multi-year leases. Particularly, at the end of 2023, STAG’s properties featured a remaining weighted average lease term of 4.3 years. This ensures both long-term visibility for lessors and a stream of predictable cash flows for STAG.

This comes with an additional benefit, too. With STAG demonstrating years of stable cash flow and near 100% occupancy rates, management has been able to secure favorable borrowing terms. STAG’s weighted average interest rate remains at 3.8%, even in the current interest rate environment. There are also no significant near-term maturities, with STAG’s weighted average maturity duration at a healthy level of 4.3 years.

Accordingly, interest expenses remained under control this year, and STAG was once again able to grow AFFO per share. However, AFFO per share rose by just 3.6% to $2.29.

For context, STAG’s AFFO per share CAGR over the past five years stands at 6.2%. The fact that interest rates remain high may continue to hamper STAG’s profitability prospects, as evidenced by the below-average AFFO per share growth last year. Nevertheless, once interest rates normalize, AFFO per share growth should rebound by 5-6%. STAG’s 2.7% weighted average annual escalation rate and lower interest costs should be the main drivers.

Dividend Growth Prospects Remain Soft, Nonetheless

Although STAG’s portfolio is likely to match the robust performance it has shown in recent years, I believe that the stock’s overall dividend growth prospects remain soft.

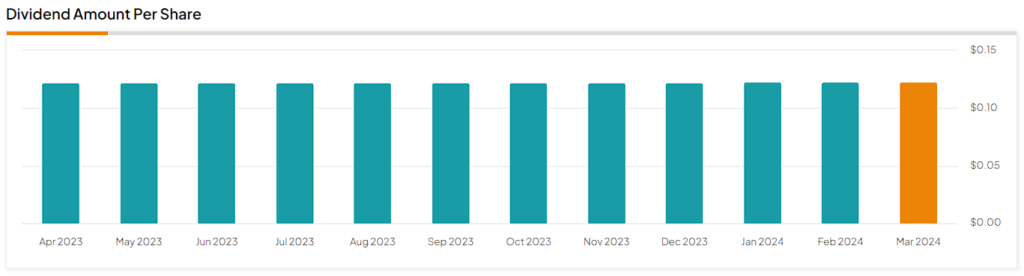

That’s not to say that STAG is not an attractive dividend stock. The appealing frequency of monthly payouts, together with a 3.9% yield and a proven track record of dividend growth (13 years of consecutive annual dividend hikes), form an attractive dividend profile.

That said, dividend increases are likely to continue to underperform inflation. For context, even though STAG has put out a commendable dividend growth track record spanning over a decade, its dividend growth CAGR over the past five and 10 years stands at 0.7% and 2.5%, respectively. STAG’s most recent dividend increase this January was also by a rather underwhelming rate of 0.7%.

I believe this trend is likely to continue, as STAG likely aims to moderate its payout ratio before potentially pursuing property acquisitions once interest rates ease. Besides, the highly attractive frequency of payouts has historically resulted in STAG stock retaining a strong shareholder base and experiencing little volatility without notable dividend increases. Thus, management is not in a hurry to boost the dividend substantially.

In any case, the risk here is that such a pace of dividend growth could potentially underperform inflation, as has been the case in previous years. Therefore, I believe the stock is only suitable for very conservative income investors who seek reliable dividends and low volatility returns but do not expect notable capital and/or dividend growth.

Is STAG Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, STAG Industrial features a Hold consensus rating based on two Buys, five Holds, and one Sell assigned in the past three months. At $39.63, the average STAG Industrial stock forecast implies 5.65% upside potential.

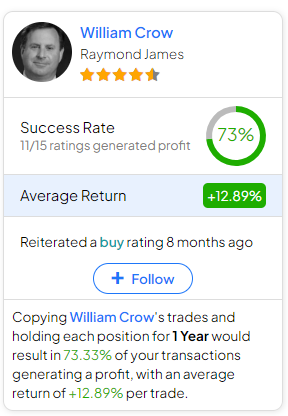

If you’re not sure which analyst you should follow if you want to buy and sell STAG stock, the most profitable analyst covering the stock (on a one-year timeframe) is William Crow from Raymond James. He boasts an average return of 12.89% per rating and a 73% success rate. Click on the image below to learn more.

The Takeaway

To sum up, I believe that STAG Industrial offers a reliable, steady monthly dividend, which makes it an appealing option for conservative income investors. However, beyond its reliable income stream, there isn’t too much to like. Sure, its resilient property portfolio should keep producing consistent cash flows, but dividend growth is likely to remain marginal, potentially failing to keep pace with inflation. Thus, the stock has a limited target group of investors, in my view.