Tron (TRX-USD) is quickly becoming a major player, challenging Ethereum’s (ETH-USD) dominance in the stablecoin market. As cryptocurrencies play a crucial role in the crypto market’s liquidity, recent trends show a shifting landscape in DeFi.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Stablecoin Breakdown: Ethereum vs. Tron

According to research from CryptoSlate, Ethereum’s stablecoin dominance is spread across several tokens: USDT-USD ($44.517 billion), USDC-USD ($21.688 billion), DAI-USD ($4.746 billion), USDe ($2.905 billion), and FDUSD-USD ($2.447 billion).

Tron, on the other hand, is all-in on USDT, which makes up $55.981 billion of its stablecoin market cap. The difference is clear: Ethereum relies on a mix of stablecoins, while Tron bets heavily on USDT. This shows Tron’s focus and strength in native stablecoin issuance, compared to Ethereum’s diversified approach.

The total value locked (TVL) across all DeFi protocols is sitting at $107.427 billion, with Ethereum hogging 61.01% of that pie. That’s $65.5 billion, if you’re counting. Meanwhile, Tron is creeping up with 7.76%, and while that might seem small in comparison, the gap is closing faster than you might think.

Bridging the Gap: Cross-Chain Liquidity

Bridged stablecoins are a big deal for cross-chain activity. BSC and Arbitrum (ARB-USD) are leading the charge here with $4.577 billion and $2.762 billion in bridged stablecoins, respectively. This means these chains are pulling users and liquidity from other blockchains, making them important players in the DeFi space.

Ethereum has $89.375 billion worth of stablecoins issued on-chain, but only $15.04 million bridged from other chains. Tron boasts $59.101 billion in native issuance with zero reliance on bridged assets. This shows Tron’s strength in native stablecoin transactions, likely due to its lower fees and faster processing times.

Despite Ethereum’s current dominance in Total Value Locked (TVL), its grip on the DeFi market is being challenged by Tron’s rapid growth. The substantial stablecoin market cap on Tron and its preference for native stablecoin transactions indicate a shift in user behavior, favoring Tron’s efficient and cost-effective transactions.

Is Tron a Buy?

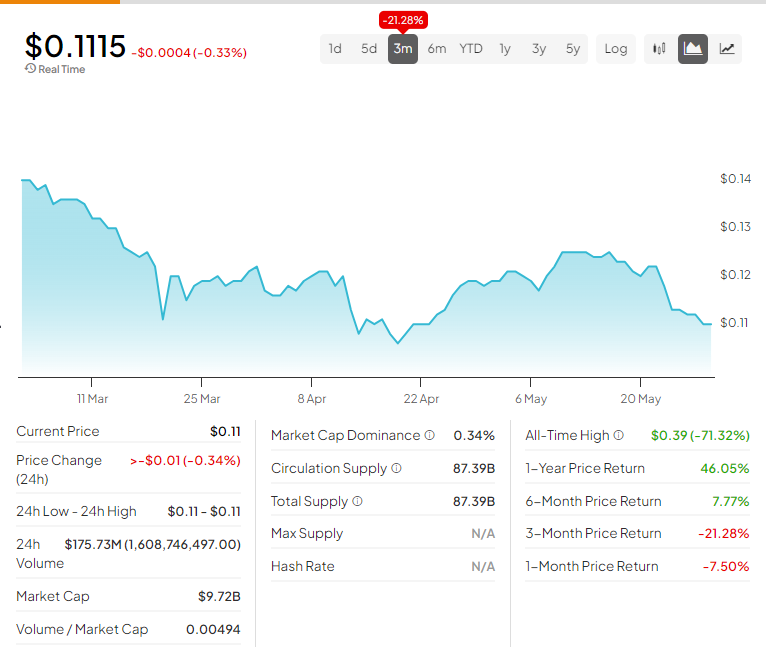

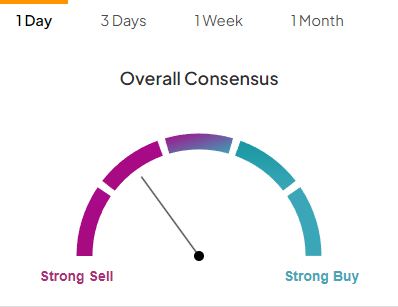

According to TipRanks’ Summary of Technical Indicators, Tron is a Sell.

Don’t let crypto give you a run for your money. Track coin prices here.