SSE (GB:SSE) recently reported its Q1 trading update for FY 2023, with the company’s total renewable output at 2,129 GWh (Gigawatt hours), which 24% higher than the previous year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SSE’s output from renewable sources across the UK and Ireland was 93GWh, which was 5% higher than what was expected.

The company’s gas-fired generation output was also slightly ahead at 3,809 GWh, from last year’s number of 3,751 GWh.

The company restated its full-year annual guidance for adjusted earnings per share of 120p, which is 26% higher than the previous year.

Boost from renewable energy

The company will further benefit from a production boost from its upcoming projects, such as the Seagreen offshore wind farm which will generate its first power by the end of this month.

More projects, such as the Viking onshore wind farm, which will be one of its most productive assets, will start operations in 2024. Dogger Bank A, B, and C offshore wind farms’ first power is expected in summer 2023.

The company is betting big on clean power projects with its investments. It aims to push its renewable energy output to 30TWh (Terawatt-hour) by 2030. SSE will invest £7.5 billion in renewables up to 2025.

SSE finance director Gregor Alexander said, “The strength of SSE’s integrated and balanced business model, combined with our commitment to positive engagement with key stakeholders, is serving us well through a period of market, political and regulatory complexity.

We remain confident in our financial outlook for strong earnings growth this year and look forward to updating the market on performance in our interim results statement on 16 November 2022.”

Focused on dividends

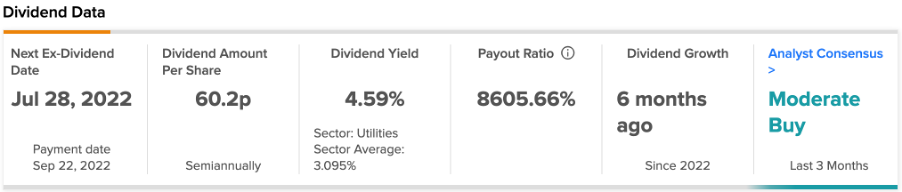

The company is no exception to the fact that the utility sector pays attractive dividends. SSE’s dividend yield is 4.6%, which is higher than the sector average of 3.09%. If the company’s transition towards renewable energy generates steady cash, investors could benefit from sustainable dividends.

View from the City

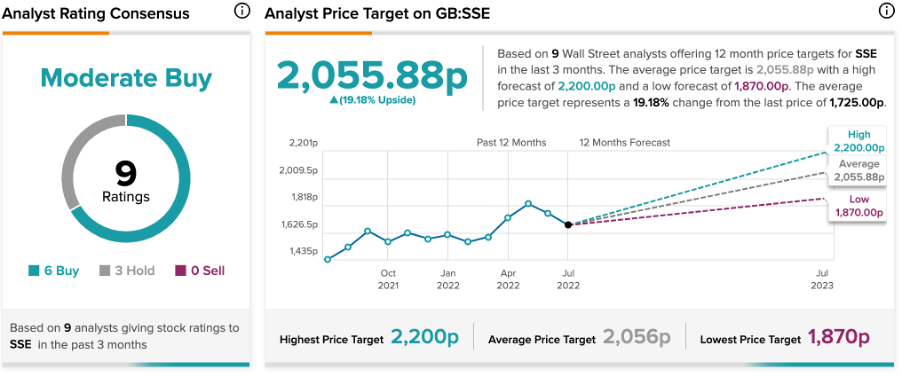

According to TipRanks’ analyst rating consensus, SSE Group stock has a Moderate Buy rating from 9 analysts, including six Buy and three Hold recommendations.

The SSE average price target is 2,055.8p, which represents a 19% change in the price from the current level. The target price has a high forecast of 2,200p and a low forecast of 1,870p.

Ending thoughts

The company recently escaped the windfall tax, which pushed its stock prices higher. SSE expects its earnings growth to be between 7-10% per year till 2026. Positive earnings could help to lift the stock further.