Block (NYSE:SQ) increased in pre-market trading after the company reported better-than-expected Q1 results. Block, formerly Square, reported adjusted earnings of $0.85 per share, compared to earnings of $0.43 per share in the same period last year. This was above Street estimates of $0.72 per share. The crypto-focused company generated revenues of $5.96 billion, up by 19% year-over-year, and surpassed consensus estimates of $5.82 billion.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Cash App – Block’s Key Mobile Payment Platform

In Q1, Cash App, Block’s popular mobile payment platform, saw significant growth, generating $4.17 billion in revenues, marking a 23% year-over-year increase. Additionally, it reported $1.26 billion in gross profit, up by 25% year-over-year. Cash App accounted for 69.9% of Block’s total revenues in Q1. Jack Dorsey announced that the platform’s Cash App Card monthly active users (MAUs) reached 24 million in March.

In March, Block reported 57 million monthly transacting users for Cash App, reflecting a 6% increase year over year. Additionally, inflows per transacting user reached $1,255, marking an 11% increase year over year. Block defines inflows per transacting active as total inflows in the quarter divided by the monthly active users for the last month of the quarter.

Block’s Q2 and FY24 Outlook

In the second quarter, the company expects its adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) to range from $670 million to $690 million with operating margin likely to be between 14% and 15%.

Block has revised its FY24 outlook, now anticipating adjusted EBITDA of $2.76 billion, up from its previous forecast of $2.63 billion. Additionally, adjusted operating income is expected to reach $1.3 billion, compared to its previous forecast of $1.15 billion.

Is SQ a Good Stock to Buy?

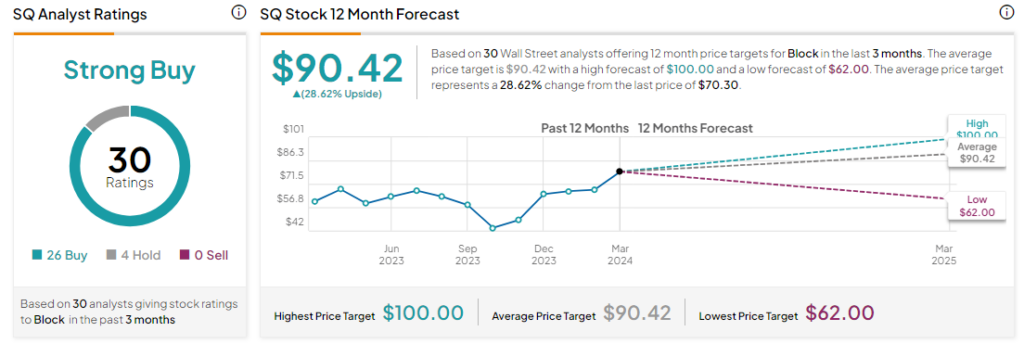

Analysts remain bullish about SQ stock, with a Strong Buy consensus rating based on 26 Buys and four Holds. Over the past year, SQ has increased by more than 15%, and the average SQ price target of $90.42 implies an upside potential of 28.6% from current levels.