The SPDR S&P 500 ETF Trust (SPY) ended 0.1% higher on Friday. The ETF witnessed a volatile session today, primarily due to a concerning drop in U.S. consumer sentiment, continued volatility in the technology sector, and a prolonged U.S. government shutdown.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Within SPY’s holdings, the Energy, Real Estate, Materials, and Utilities sectors posted gains today, while the Consumer Discretionary, Technology, and Communication Services declined.

Importantly, SPY closely tracks the S&P 500 Index (SPX), which rose 0.13%. Also, the tech-heavy Nasdaq 100 (NDX) fell 0.28%.

Key Catalysts That Can Move SPY

Looking ahead, the ongoing and historically long U.S. government shutdown is a potential catalyst for volatility in the SPY ETF. Any news suggesting a potential end to the shutdown could drive the ETF higher.

Also, several Federal Reserve officials are scheduled to speak next week, and their comments could impact investor sentiment and interest rate expectations.

Lastly, the earnings reports from major companies, such as Cisco (CSCO) and The Walt Disney Company (DIS), can influence the performance of the SPY ETF.

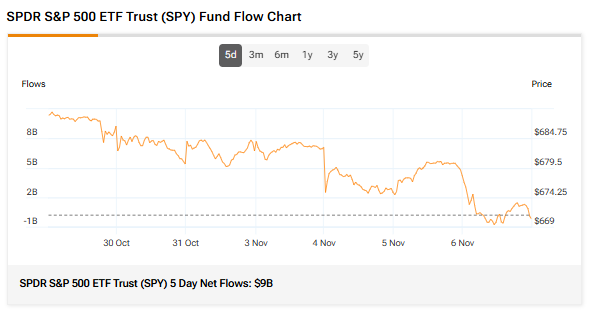

Fund Flows and Sentiment

SPY’s 5-day net inflows totaled $9 billion, showing that investors put capital in SPY over the past five trading days. Meanwhile, its three-month average trading volume is 73.06 million shares.

It must be noted that retail sentiment remains neutral, while hedge fund managers have increased their holdings of the SPY ETF in the last quarter.

SPY’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY is a Moderate Buy. The Street’s average price target of $780.62 for the SPY ETF implies an upside potential of 16.34%.

Currently, SPY’s five holdings with the highest upside potential are DuPont de Nemours (DD), Loews (L), Fiserv (FI), Moderna (MRNA), and Norwegian Cruise Line (NCLH).

Meanwhile, its five holdings with the greatest downside potential are Tesla (TSLA), Incyte (INCY), Paramount Skydance (PSKY), Micron (MU), and Applied Materials (AMAT).

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.