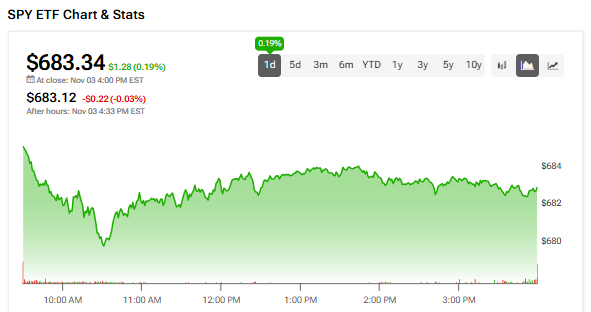

The SPDR S&P 500 ETF Trust (SPY) gained 0.19% on Monday. Key factors influencing the market today include comments from Fed officials dimming hopes for a December rate cut, the ongoing U.S. government shutdown, and a report showing weak manufacturing activity data.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Within SPY’s holdings, the Consumer Discretionary, Technology, and Healthcare sectors posted gains today, while the Consumer Staples, Real Estate, and Materials sectors declined.

Importantly, SPY closely tracks the S&P 500 Index (SPX), which ended 0.17% higher. Also, the tech-heavy Nasdaq 100 (NDX) gained 0.44%.

What Impacted the Market Today?

Today, comments from Fed officials Lisa Cook, Austan Goolsbee, and Mary Daly have cast doubts on a potential rate cut in December, raising market uncertainty. Also, the market reacted to disappointing manufacturing activity data released today.

Looking ahead, events that can trigger volatility in the SPY ETF include the ongoing U.S. government shutdown and the release of key economic data, such as the ADP National Employment Report and Services PMI readings, which will provide clues about the economy’s health.

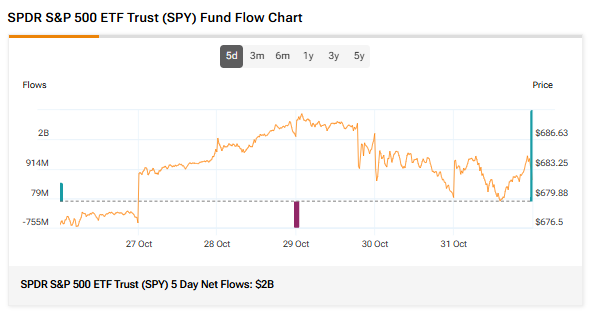

Fund Flows and Sentiment

SPY’s 5-day net inflows totaled $2 billion, showing that investors put capital in SPY over the past five trading days. Meanwhile, its three-month average trading volume is 72.99 million shares.

It must be noted that retail sentiment remains neutral, while hedge fund managers increased their holdings of the SPY ETF in the last quarter.

SPY’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY is a Moderate Buy. The Street’s average price target of $774.16 for the SPY ETF implies an upside potential of 13.29%.

Currently, SPY’s five holdings with the highest upside potential are Loews (L), Fiserv (FI), Dexcom (DXCM), Smurfit Westrock (SW), and Moderna (MRNA).

Meanwhile, its five holdings with the greatest downside potential are Palantir (PLTR), Super Micro Computer (SMCI), Paramount Skydance (PSKY), Tesla (TSLA), and Intel (INTC).

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.