The SPDR S&P 500 ETF Trust (SPY) gained 0.67% on Monday, primarily driven by a surge in energy and financial stocks following a U.S. military operation in Venezuela.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Importantly, SPY closely tracks the S&P 500 Index (SPX), which was up 0.64%, while the tech-heavy Nasdaq-100 (NDX) gained 0.77%.

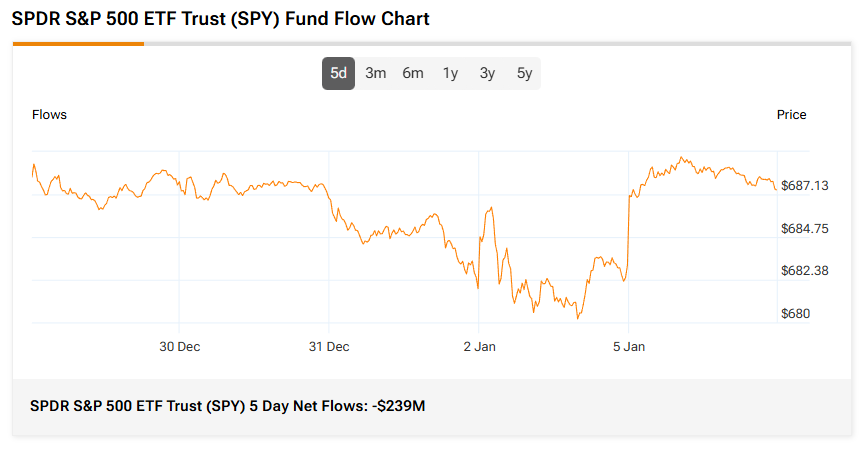

Fund Flows and Sentiment

SPY’s five-day net outflows totaled $239 million, showing that investors pulled out capital from SPY over the past five trading days. Meanwhile, its three-month average trading volume is 80.51 million shares.

It must be noted that the retail sentiment for the SPY ETF is positive, while hedge fund managers have decreased their holdings of the ETF in the last quarter.

SPY’s Price Forecast

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY has a Moderate Buy rating. The Street’s average price target of $797.47 for the SPY ETF implies an upside potential of 15.96%.

Currently, SPY’s five holdings with the highest upside potential are:

- Texas Pacific Land (TPL)

- Oracle (ORCL)

- Datadog (DDOG)

- Super Micro Computer (SMCI)

- The Trade Desk (TTD)

Meanwhile, its five holdings with the greatest downside potential are:

- Warner Bros. Discovery (WBD)

- Expeditors International of Washington (EXPD)

- JB Hunt Transport (JBHT)

- Tesla (TSLA)

- Albemarle (ALB)

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market over the long term.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, with High Upside Potential, carefully curated based on TipRanks’ analysis.