The SPDR S&P 500 ETF Trust (SPY) is down 0.13% in the pre-market trading session on Tuesday. The fall appears to be driven by broader market caution ahead of key U.S. economic data, particularly the December CPI inflation report.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Importantly, SPY closely tracks the S&P 500 Index (SPX), which gained 0.16% yesterday, while the tech-heavy Nasdaq-100 (NDX) rose 0.08%.

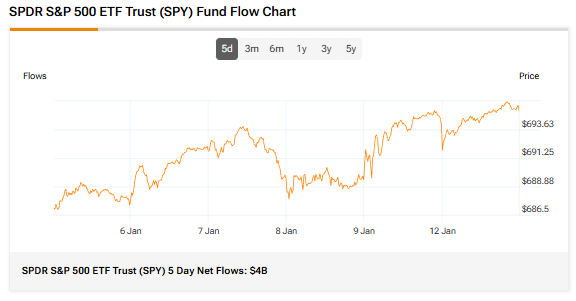

Fund Flows and Sentiment

SPY’s five-day net inflows totaled $4 billion, showing that investors put capital into SPY over the past five trading days. Meanwhile, its three-month average trading volume is 79.66 million shares.

It must be noted that the retail sentiment for the SPY ETF is positive, while hedge fund managers have decreased their holdings of the ETF in the last quarter.

Key Catalysts That Can Move SPY ETF This Week

The key catalysts for the SPY this week are the December Consumer Price Index (CPI) inflation report and the start of the fourth-quarter corporate earnings season. Also, comments from Federal Reserve officials could influence market sentiment.

Fourth-quarter earnings season begins this week. Several major banks, including JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Goldman Sachs (GS), Morgan Stanley (MS), and Wells Fargo (WFC), will report results.

SPY’s Price Forecast

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY has a Moderate Buy rating. The Street’s average price target of $799.22 for the SPY ETF implies an upside potential of 14.97%.

Currently, SPY’s five holdings with the highest upside potential are:

- Texas Pacific Land (TPL)

- Datadog (DDOG)

- The Trade Desk (TTD)

- ServiceNow (NOW)

- News Corporation (NWSA)

Meanwhile, its five holdings with the greatest downside potential are:

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market over the long term.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, with High Upside Potential, carefully curated based on TipRanks’ analysis.