SPS Commerce (SPSC) stock plummeted on Friday following the release of the cloud-based supply chain management solutions company’s Q3 2025 earnings report. This report began with adjusted earnings per share of $1.13, compared to Wall Street’s estimate of $1. Its adjusted EPS also increased 22.83% year-over-year from 92 cents.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue reported by SPS Commerce was $189.9 million, which was below analysts’ estimate of $192.67 million. That’s despite a 16% growth year-over-year from $163.7 million. Chad Collins, CEO of SPS Commerce, noted, “Despite ongoing global trade and economic uncertainty, and the spend scrutiny we’re seeing across some of our customer groups this year, we believe the ever-evolving retail ecosystem will continue to drive the need for supply chain efficiencies.”

SPS Commerce stock was down 32.84% in pre-market trading on Friday, following a 1.23% dip yesterday. The shares have also fallen 43.53% year-to-date and 37.59% over the past 12 months.

SPS Commerce Guidance

SPS Commerce also provided investors with a guidance update in its latest earnings report. For Q4 2025, the company expects adjusted EPS to range from 98 cents to $1.02, alongside revenue of $192.7 million to $194.7 million. This doesn’t look good when compared to Wall Street’s Q4 estimates, which include adjusted EPS of $1.03 on revenue of $196.68 million.

SPS Commerce also included guidance for the full year of 2025 in its latest earnings report. The company expects adjusted EPS between $4.10 and $4.15 with revenue of $751.6 million to $753.6 million. For perspective, analysts expect adjusted EPS of $4.14 on revenue of $758.41 million for the year.

Is SPS Commerce Stock a Buy, Sell, or Hold?

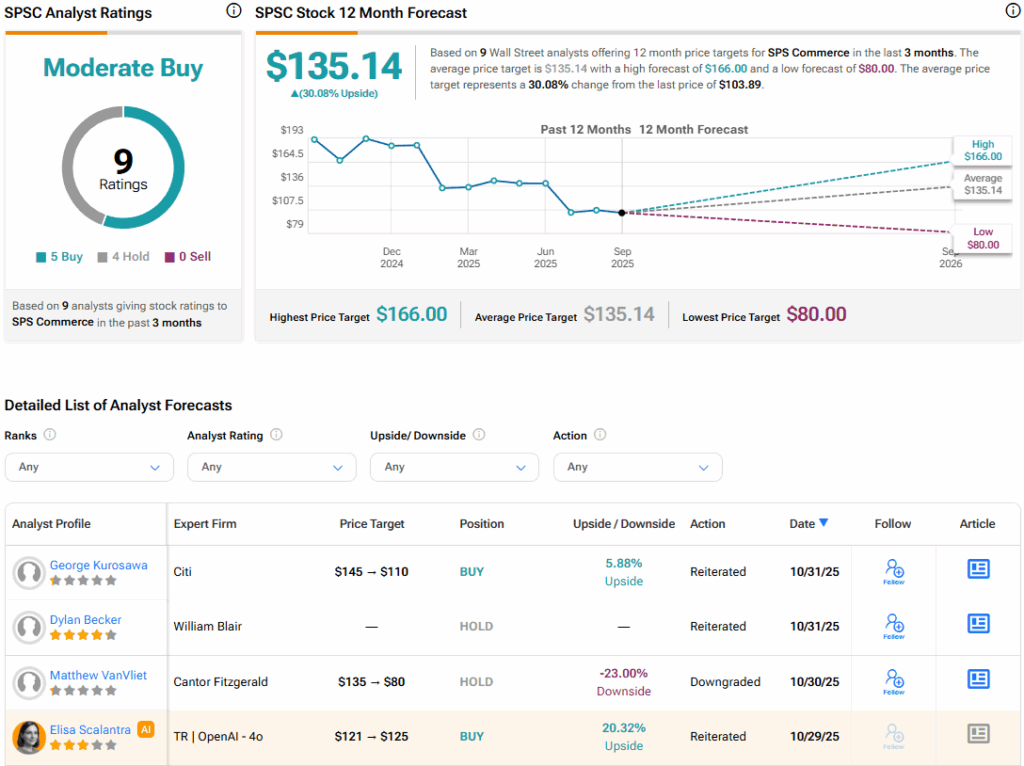

Turning to Wall Street, the analysts’ consensus rating for SPS Commerce is Moderate Buy, based on five Buy and four Hold ratings over the past three months. With that comes an average SPSC stock price target of $135.14, representing a potential 30.08% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.