Spirit AeroSystems’ (SPR) net loss significantly widened in the second quarter. The company attributed the weak results to lower 737 fuselage shipments to Boeing (BA) and rising costs associated with Airbus’s (EADSY) A220 program. SPR manufactures wing structures for the Airbus A220 aircraft.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SPR is a supplier of commercial and defense aircraft parts, such as wings, fuselages, and other structural elements.

SPR: Q2 Highlights

Spirit delivered net revenue of $1.49 billion in Q2, up 9% year-over-year but short of analysts’ expectations of $1.58 billion. Additionally, SPR reported an adjusted net loss of $2.73 wider than the net loss of $1.46 in the year-ago quarter. It also compared unfavorably with the Street’s forecast of a net loss of $0.92 per share.

Furthermore, the company’s financial health deteriorated in Q2. SPR burned through $597 million in cash during the quarter. Nevertheless, Spirit’s backlog remained robust at $48 billion.

Key Performance Issues

One of the major factors that hurt Spirit’s Q2 performance was lower deliveries of the 737 Max fuselages. It shipped only 27 fuselages in the quarter, a sharp decline from 74 in the year-ago quarter. This reduction is attributed to Boeing’s ongoing production constraints imposed by regulators following a safety incident.

Spirit’s financial performance was further impacted by increased costs related to the Airbus A220 program. The company recorded $25 million in forward losses, bringing the total to $214 million.

Merger with Boeing Looms Large

Amidst these financial setbacks, Spirit signed a merger agreement with Boeing on July 1, with plans to finalize the deal by mid-2025. While this merger could be a potential lifeline for the combined entity, its success remains uncertain given the current challenges faced by both companies.

The performance of Boeing and Spirit is being affected by lower production rates, rising costs, weak financials, and regulatory scrutiny. It would be interesting to see how the companies address these challenges to ensure a smooth transition.

Now, let’s take a look at what Wall Street analysts think about BA stock’s prospects.

Is BA Stock a Good Buy?

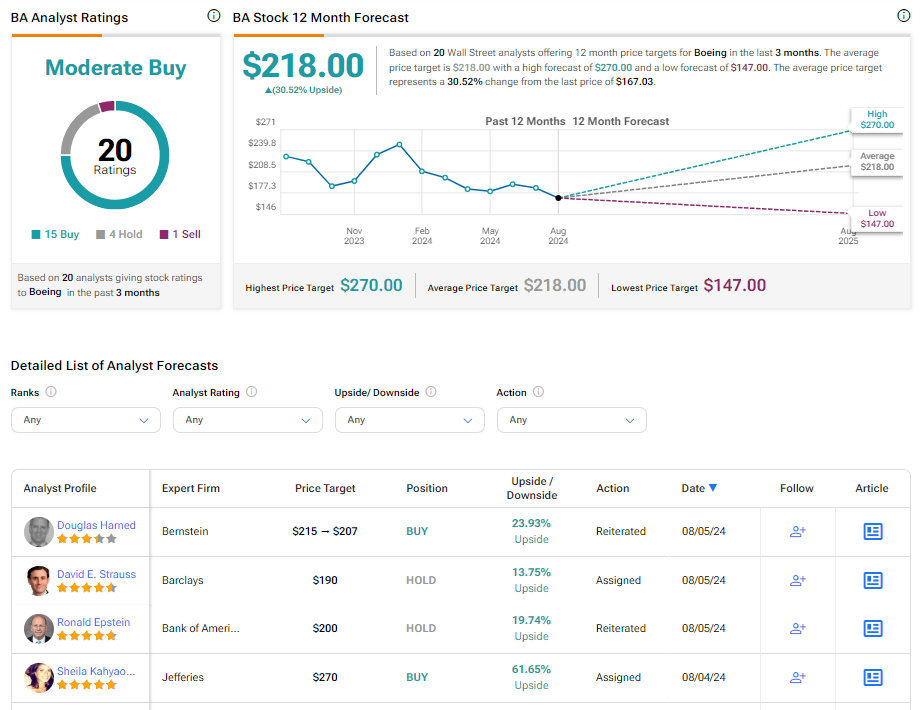

Analysts remain cautiously optimistic about BA stock, with a Moderate Buy consensus rating based on 15 Buys, four Holds, and one Sell. Analysts’ average price target on Boeing stock of $218 implies an upside potential of 30.5% from current levels.