Spotify (SPOT) enters 2026 as a favorite among institutional investors, with its stock currently trading at $573.88. After a transformative 2025, the company has successfully shifted its narrative from a simple music streamer to a highly profitable audio platform. With a consensus rating of Moderate Buy from 34 research firms, the market is pricing in a massive expansion of Spotify’s earnings power over the next twelve months.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A major leadership transition is also in full effect. On January 1, 2026, Alex Norström and Gustav Söderström officially joined the Board of Directors, while founder Daniel Ek continues his strategic role as Executive Chairman. Here are the specific analyst catalysts driving the stock toward a consensus target of $760.23, with some firms eyeing much higher levels.

1. The $860 High-End Target from Benchmark

Benchmark remains one of the most bullish firms on the Street, with analyst Mark Zgutowicz recently raising his price target from $800 to $860. Analysts there are focused on the strength of Spotify’s Premium Average Revenue Per User (ARPU). They believe that even with global economic shifts, Spotify’s core subscribers are showing high loyalty, which allows the company to improve its profit margins faster than competitors.

2. KeyBanc’s Focus on Underestimated Growth

KeyBanc’s Justin Patterson maintains an Overweight rating with an $830 price target. Their research suggests that current market estimates are actually understating Spotify’s medium-term margin profile. KeyBanc analysts expect high-teens revenue growth through 2026 and 2027, driven by new product levers that increase user engagement and a gross margin that is now consistently exceeding 31.7%.

3. Deutsche Bank’s Price Hike Analysis

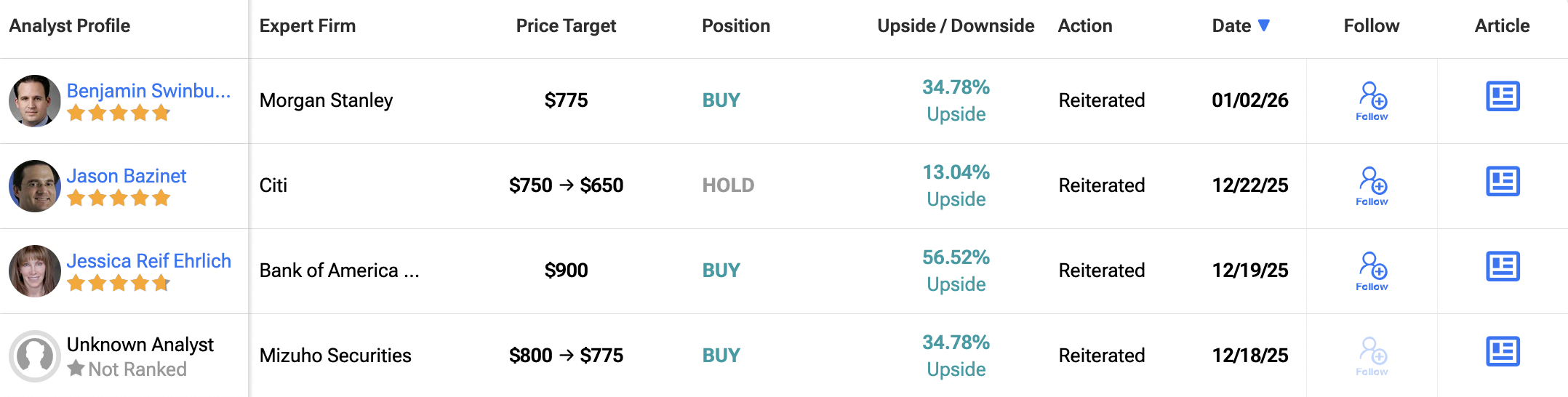

Deutsche Bank’s Benjamin Black has reiterated its Buy rating with a $775 target. Their analysis shows that even a standard $1 per month price increase in the U.S. could boost Spotify’s 2026 operating income by 9%. This pricing power is a game-changer for the company’s valuation, as it allows revenue to grow significantly without a corresponding increase in content or operating costs.

4. Evercore ISI and the $900 Bull Case

Leading the top end of the market, Evercore ISI and BNP Paribas Exane have issued some of the highest targets at $900. These firms view Spotify as a dominant winner in the “Application-Layer Rotation,” where AI is used to make the platform stickier for its 713 million monthly active users. Evercore analysts believe the stock is still trading below its fair value when accounting for the massive earnings growth forecast for the next three years.

Overall, the takeaway for investors is that Spotify has moved beyond the growth-at-all-costs phase. The company is now delivering on its promise of operational leverage, where profits grow much faster than expenses.

Is Spotify a Good Stock to Buy?

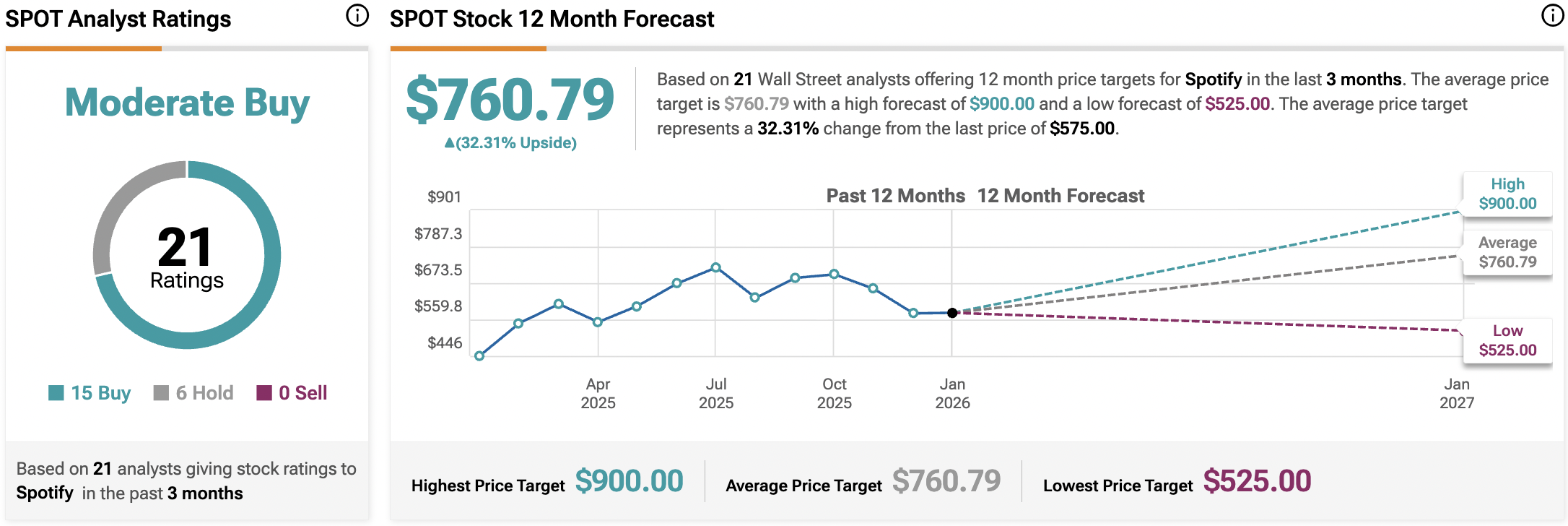

Spotify has a Moderate Buy consensus rating among Wall Street analysts as of January 2026. This rating is based on 15 Buys and 6 Hold ratings issued within the last three months. The average 12-month SPOT stock price target is $760.79, pointing to a 32.3% upside from the current price.