Spotify (NYSE:SPOT) shares surged in the early session today after the audio streaming platform’s fourth-quarter revenue jumped by 16% year-over-year to €3.7 billion. Further, its net loss per share narrowed to €0.36 from €1.40 in the year-ago period.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, total monthly active users (MAUs) increased by 23% to 602 million, and the number of premium subscribers ticked up by 15% to 236 million. Notably, ad-supported MAUs rose by a healthy 28% to 379 million.

The company’s gross margin expanded by 140 basis points to 26.7%. Further, lower marketing and personnel costs helped narrow the operating loss to €75 million from €231 million in the year-ago period. Additionally, free cash flow for the quarter stood at €396 million.

For the upcoming quarter, Spotify expects to add 16 million net new MAUs and 3 million net new premium subscribers. The company also anticipates €180 million in operating income on revenue of €3.6 billion.

Is SPOT a Good Stock to Buy?

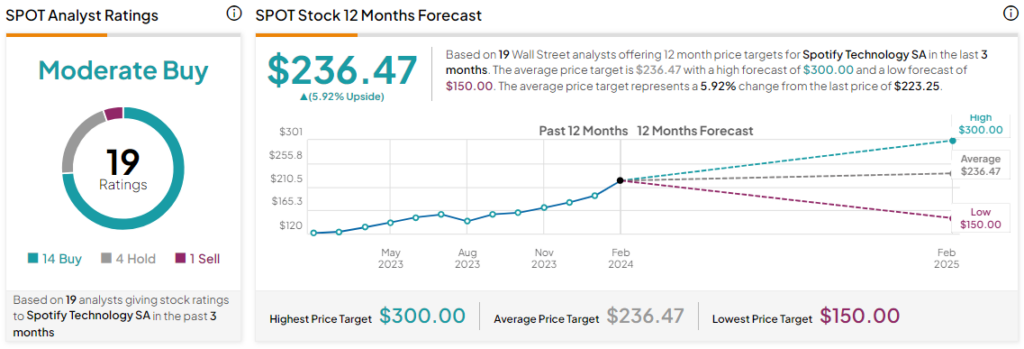

Overall, the Street has a Moderate Buy consensus rating on Spotify, and the average SPOT price target of $236.47 implies a modest 5.9% potential upside in the stock. With the rising adoption of audio streaming, shares of the company have surged by nearly 82% over the past year.

Read full Disclosure