Shares of aerospace company Virgin Galactic (NYSE:SPCE) fell in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at -$0.26, which beat analysts’ consensus estimate of -$0.30 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales increased by 223% year-over-year, with revenue hitting $2.81 million. This missed analysts’ expectations by $160,000.

Looking forward, management now expects revenue for Q1 2024 to be $2 million. In addition, free cash flow is seen landing between -$135 million and -$125 million.

Is Virgin Galactic a Buy, Sell, or Hold?

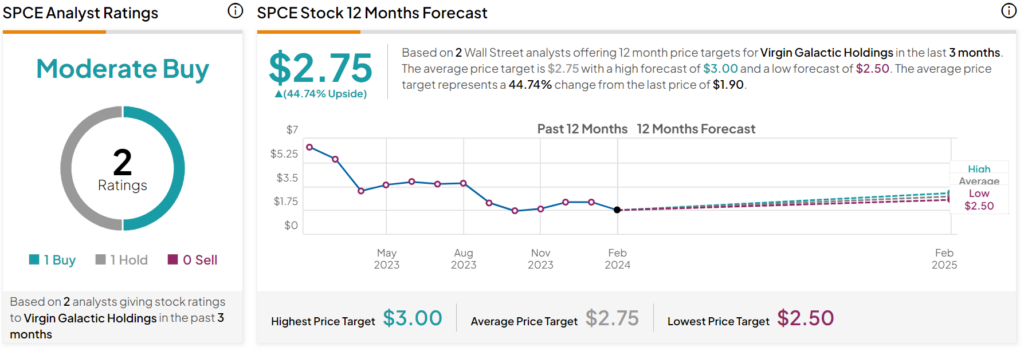

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SPCE stock based on one Buy and one Hold assigned in the past three months, as indicated by the graphic below. After a 66% decline in its share price over the past year, the average SPCE price target of $2.75 per share implies 44.74% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.