The S&P 500 (SPX) index is up Friday as investors react to the latest economic data release. The November U.S. jobs report shows a 227,000 increase, with unemployment remaining stable at 4.2%. Investors appear hopeful that a strong job market will benefit the economy, boosting the S&P 500 by 0.23% as of this writing.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Considering this data, the Federal Reserve will likely stick to its plan of reducing interest rates this month. That would be a boon to many stocks on the S&P 500. The index includes many growth and tech stocks that are hampered by increased interest rates. Any cut would be appreciated by their shareholders.

Stocks Lifting the S&P 500 Higher

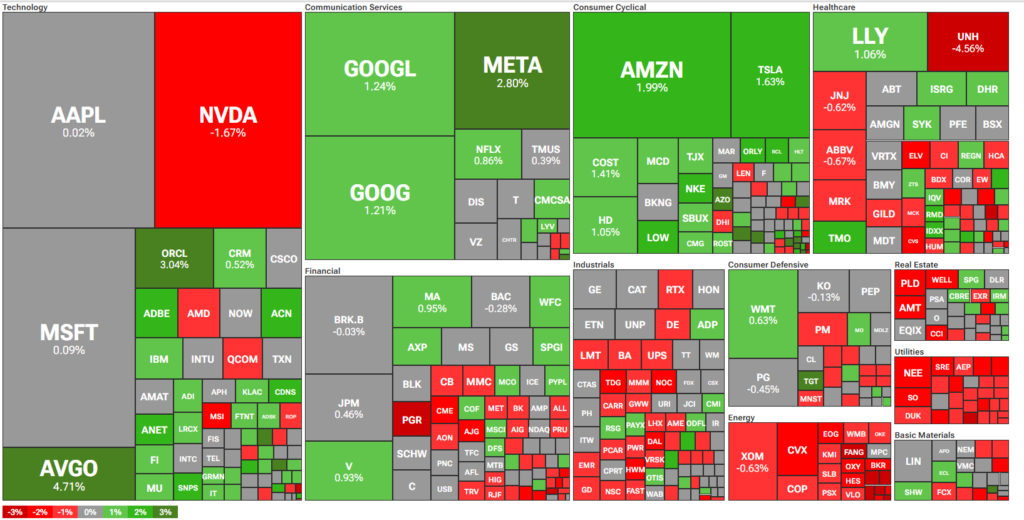

The S&P 500’s rally is fueled by major gains at several big companies. That includes a 4.71% increase for Boardcom (AVGO), a 3.04% rise for Oracle (ORCL), a 2.8% climb for Meta Platforms (META), and a 1.99% boost for Amazon (AMZN). Additionally, many other stocks in the index are experiencing smaller rallies today that are helping lift the overall value of the S&P 500.

How To Invest in the S&P 500

There’s no option to invest in the S&P 500, but there are alternatives. For example, a trader might pick a few top-performing companies in the index and invest in them directly. Those biggest gainers mentioned above are all solid options for investors to consider a stake in.

On top of that, there are exchange-traded funds (ETFs) that track the S&P 500. Investors can buy into these as another form of indirect exposure to the index. A few noteworthy examples include SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV), Vanguard S&P 500 ETF (VOO), iShares Core S&P 500 UCITS ETF (CSTNL), and SPDR Portfolio S&P 500 ETF (SPLG).