The S&P 500 (SPX) index slipped 0.12% at the time of writing as tech stocks pulled it down after a rally earlier this week. Several of the biggest tech stocks have risen throughout the week alongside promising economic data and major announcements. This caused strong rallies that started on Wednesday, lifting the S&P 500 as well.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, the hype around tech stocks is starting to wear off as investors head into the weekend. With that comes a drop in share prices as they settle at more reasonable levels. That’s not to say the S&P 500 is in trouble, as it’s still up 26.87% year-to-date.

Which Stocks Hit the S&P 500 the Hardest Today?

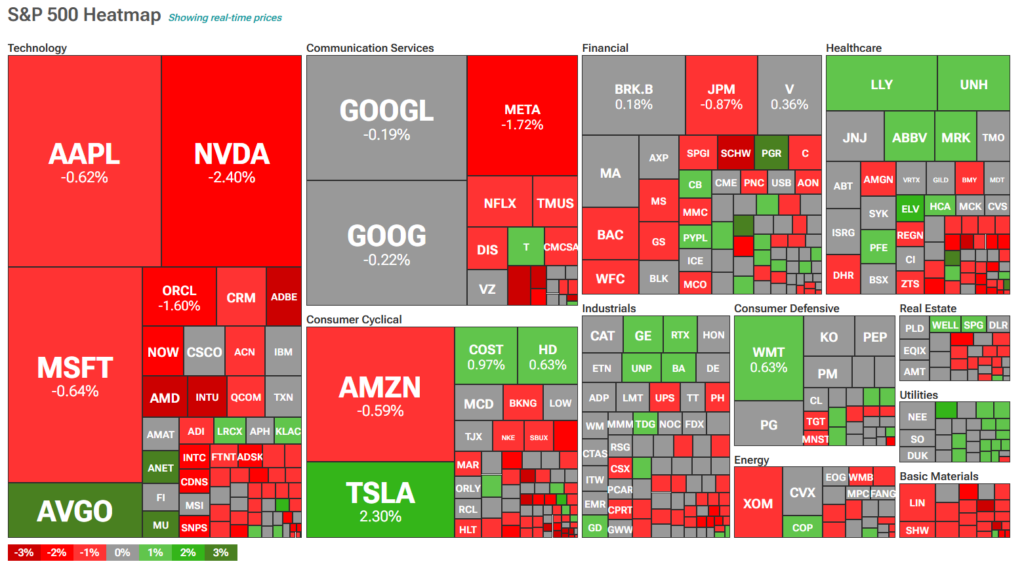

Looking at the S&P 500 heatmap, Nvidia (NVDA), Oracle (ORCL), and Meta Platforms (META) appear to be doing the most damage to the index today. Investors will also note that drops from Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) aren’t helping the index out on Friday, with each experiencing slight decreases.

Hot to Invest in the S&P 500

The S&P 500 is an index, meaning it can’t be invested in directly. Instead, traders may want to buy stocks with potential upside. Buying the above stocks might be a solid strategy if traders believe the dip is a good entry point. They could also buy those performing well today, such as Broadcom (AVGO) or Tesla (TSLA).

Another option is investing in exchange-traded funds (ETFs) that track the S&P 500. A few worth noting are SPDR S&P 500 ETF (SPY), Vanguard S&P 500 ETF (VOO), iShares Core S&P 500 (IVV), Ish.Frf Spx 500 (CSTNL), and SPDR Portfolio S&P 500 (SPLG).