The S&P 500 is doing great this week with the index about to close out Friday with additional gains. That’s thanks to the recovery of treasuring yields as U.S. manufacturing reports come in above experts’ estimates.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

On top of that, positive inflation data this week has lifted the stock market higher. Inflation wasn’t as high as expected in December and retail sales remained strong that month. This helped boost the index as the strong economy excited investors. Additionally, many earnings reports this week beat estimates and lifted the market up.

With all this news comes a major 1.24% increase for the SPX today. This builds on the index’s positive performance in 2024 while helping it shake off a rough start of the year.

Stocks Lifting the S&P 500 Higher Today

Turning to the TipRanks SPX heatmap tool, investors can see which stocks sent the index higher on Friday. Most sectors are green today, showing the strength of the market. One area that isn’t performing as well is healthcare with several stocks in that segment falling or lacking significant movemnt today.

How to Invest in the S&P 500 Index

Traders can’t take a direct stake in the S&P 500 as it’s only an index. Instead, they’re better off buying shares of stocks listed on it. One option they might consider is picking up shares of stocks falling today to profit on their potential recovery. Investors might also buy stakes in stocks performing well if they believe there’s more room for growth.

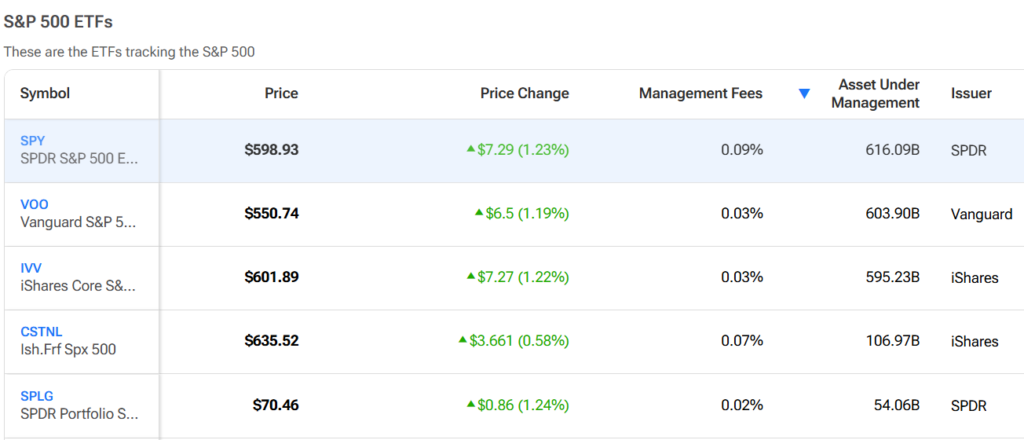

Another option is investing in an exchange-traded fund (ETF) that tracks the S&P 500 index. That includes those betting on and against the success of the SPX. One popular option among traders is the SPDR S&P 500 ETF Trust (SPY) but there are plenty others to compare.