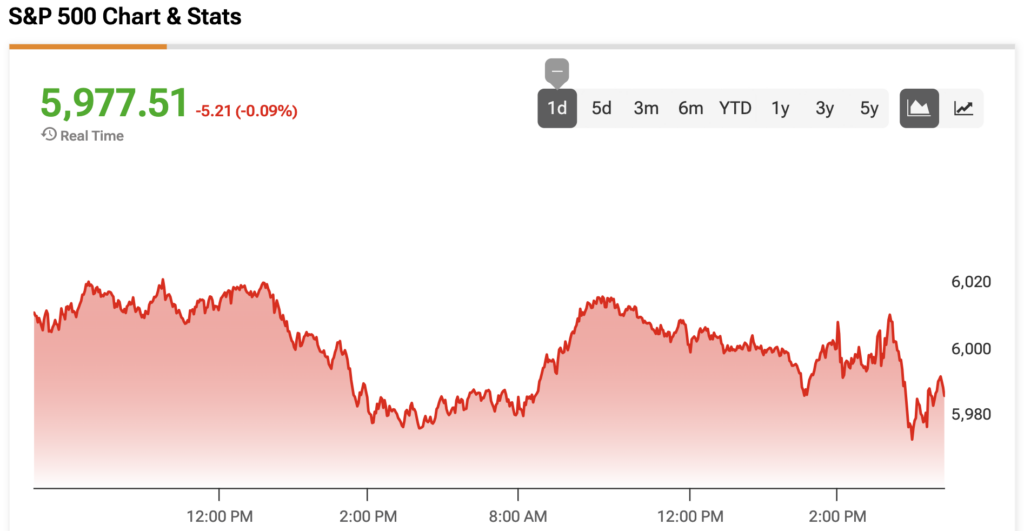

The S&P 500 (SPX) has reverted to negative territory following inflation comments from Fed Chair Jerome Powell. Powell said that the current inflation forecast is higher than the forecast when the Fed chose to cut rates by 50 basis points (bps) in September 2024. In addition, he expects a “meaningful” amount of inflation in the coming months as a result of the Trump administration’s tariffs.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The resulting price hikes from the tariffs could spill over to consumers, while a one-time price increase isn’t guaranteed, said the Fed Chair.

Fed Raises Preferred Inflation Gauge Estimate

Along with Powell’s comments, the Fed raised its 2025 core personal consumption expenditures (PCE) estimate, which is its preferred inflation gauge. Core PCE excludes volatile food and energy prices from the regular PCE, which tracks the prices that consumers pay for goods and services. The Fed now expects 3.1% core PCE in 2025, up from 2.8%. It raised its 2026 estimate to 2.4% from 2.2% and its 2027 estimate to 2.1% from 2.0%.

The S&P 500 is down by 0.09% at the time of writing.