Southwest Airlines (LUV) is making significant changes in an effort to cut costs and improve its margins, according to a CNBC report. The report cited a note by the airline’s CEO Bob Jordan to his staff on Monday.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As part of these measures, the airline is hitting a pause on corporate hiring and promotions, suspending most of its summer internships, and putting on hold employee team-building events that have been a staple since the 1980s. The decision reflects the company’s intense focus on financial performance as it navigates challenges in the competitive airline industry.

LUV Cuts Back on its Team-Building Activities

Among the new measures to cut back on costs, LUV has suspended its employee “rallies,” a team-building tradition that dates back to 1985. During these rallies, employees would gather to hear from leadership about the company’s goals for the year and enjoy food and entertainment. These moves come amid ongoing efforts to streamline operations and address the financial pressures faced by the airline.

LUV Tightens Belt to Boost Financial Performance

According to the report, Jordan stated in the note, “Every single dollar matters as we continue to fight to return to excellent financial performance.” He further explained that the company would evaluate other activities on an ongoing basis and delay them when necessary.

A Southwest spokeswoman confirmed these changes to CNBC and clarified that the airline will “continue to evaluate hiring needs on an ongoing basis to determine when it makes sense for the business to resume hiring.”

LUV Is Increasingly Under Pressure

In recent months, Southwest Airlines has been under the scrutiny of activist investor Elliott Investment Management, which pushed for leadership changes. While a settlement in October saw Jordan remain as the airline’s CEO, the company continues to prioritize efforts to regain industry-leading profit margins.

The company is expected to announce its fourth-quarter results on January 30.

Is LUV a Good Stock to Buy?

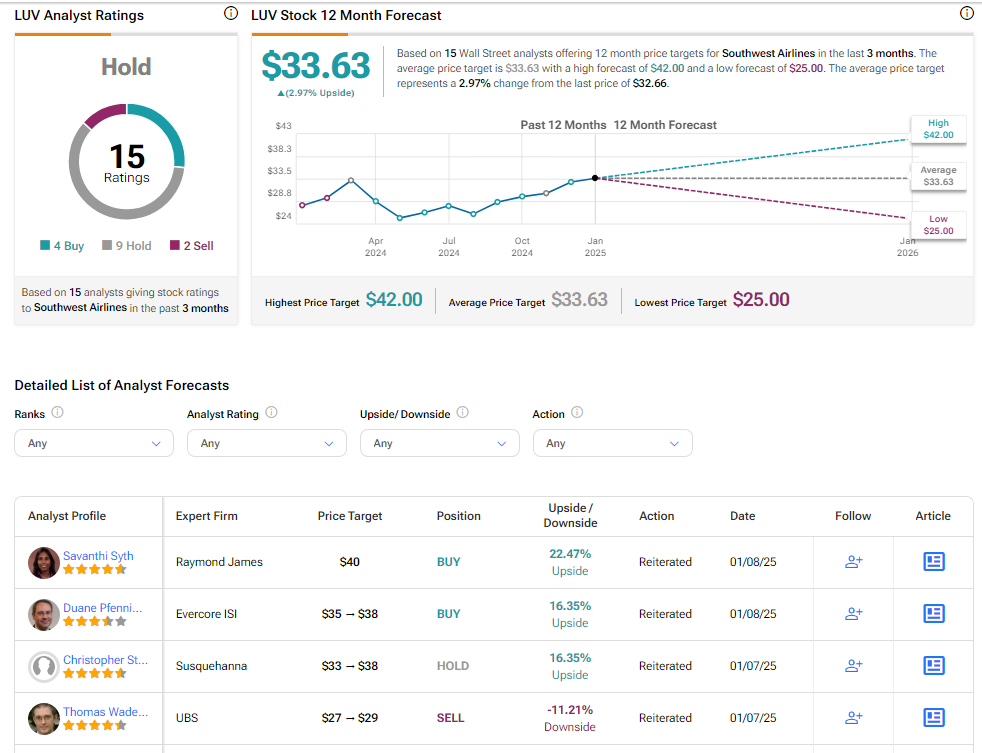

Analysts remain sidelined about LUV stock, with a Hold consensus rating based on four Buys, nine Holds, and two Sells. Over the past year, LUV has increased by more than 10%, and the average LUV price target of $33.63 implies an upside potential of 2.9% from current levels.