Artificial intelligence continues to revolutionize industries, and investors are keenly evaluating companies poised to benefit from this transformation. Among the notable players are SoundHound AI (SOUN) and Palantir Technologies (PLTR). Both companies are part of the AI revolution, but business models and customer bases set them apart. Let’s take a closer look at which stock could be the better long-term bet for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Palantir focuses on data-driven platforms and government contracts, while SoundHound specializes in fast-growing voice AI solutions. SOUN and PLTR have seen their stock increase by over 296% and 135.5%, respectively, in the last 12 months.

Is SoundHound AI Poised to Outgrow Palantir?

Among the similarities, SoundHound AI and Palantir are high-growth, high-volatility tech disruptors. Like Palantir in its early years, SoundHound is targeting a huge market with a specialized AI platform that can scale across industries.

Similarly, both SOUN and PLTR have high valuations that catch investors’ attention. SoundHound’s forward price-to-sales ratio is over 50, much higher than the sector median of 3.5. While its stock looks expensive for its current size, it has strong potential for fast growth.

Meanwhile, Palantir’s price-to-earnings ratio is 596.9, far above the sector median of 31.3. Its high valuation reflects that investors are paying a premium for its proven track record and stable contracts. Many analysts warn that Palantir’s valuation is quite high. However, others argue that its solid fundamentals and strong market position justify the premium price. While Palantir offers greater stability, its upside potential in the short term may be lower than that of smaller, faster-growing AI stocks.

SoundHound’s Revenue Growth Is Turning Heads

SoundHound had its best quarter ever in Q2, with revenue reaching a record $42.7 million, marking a 217% increase compared to the same period last year. For the full year, the company lifted its guidance to $160–$178 million, slightly above prior estimates.

At the same time, strategic partnerships with companies such as Stellantis (STLA) and Acrelec have bolstered its presence in the automotive and restaurant industries. Additionally, the acquisition of Interactions Corporation is expected to significantly contribute to revenue in the coming year.

On Wall Street, analyst sentiment is positive. Most recently, SOUN stock earned a new Street-high price target of $26 from a top-rated analyst, Scott Buck, at H.C. Wainwright. Buck believes that SoundHound’s strong business growth could offer solid long-term support for the stock.

Palantir’s Numbers Impress Too

Like SoundHound, Palantir also delivered strong Q2 results, crossing the $1 billion revenue mark for the first time. The company raised its full-year revenue forecast to $4.142–$4.150 billion for 2025, up from the previous estimate of $3.89–$3.90 billion.

On Wall Street, analysts like Piper Sandler view Palantir as a “secular winner in the AI revolution.” Analyst Clarke Jeffries believes Palantir hasn’t reached its peak growth yet and expects its strong momentum to continue. He points to over $7 billion in confirmed contracts and another $4 billion in potential IDIQ deals, giving the company solid revenue visibility. Jeffries also highlighted that Palantir’s commercial business has seen triple-digit growth in bookings so far this year.

SOUN or PLTR: Which Stock Offers Higher Upside, According to Analysts?

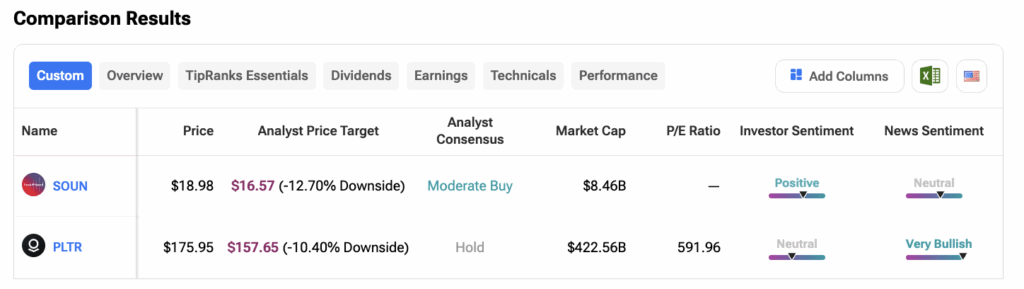

Using TipRanks’ Stock Comparison Tool, we compared SOUN and PLTR to see which AI stock analysts favor. SOUN carries a Strong Buy rating from analysts with a projected downside of over 12% at a price target of $16.67. On the other hand, PLTR stock carries a Hold rating. Palantir’s stock price forecast of $157.65 implies a downside of around 10%.

Conclusion

Both companies are experiencing strong growth at similar rates, reflecting the increasing demand for AI solutions across industries. Palantir offers a more balanced and stable business, supported by government and commercial contracts. In contrast, SoundHound AI’s stock trades at a significantly lower price than Palantir’s, making it a more affordable option for investors seeking exposure to AI innovation.

In the end, both stocks come with risks; SoundHound is the high-risk, high-reward play, while Palantir is the pricier but steadier long-term option. The right choice depends on the investor’s risk appetite and investment goals.