Voice AI has rapidly become one of the most exciting areas of innovation, as cars, apps, and connected devices get smarter at understanding how humans actually speak. Using TipRanks’ Stock Comparison Tool, we have compared SoundHound AI (SOUN) and Cerence Inc. (CRNC), standing out as key players in this specialized space.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SoundHound AI builds voice technology for everyday life, offering speech recognition and smart, two-way conversations for cars, restaurants, and connected devices. Meanwhile, Cerence focuses heavily on the automotive world, supplying AI-powered voice software to major car brands.

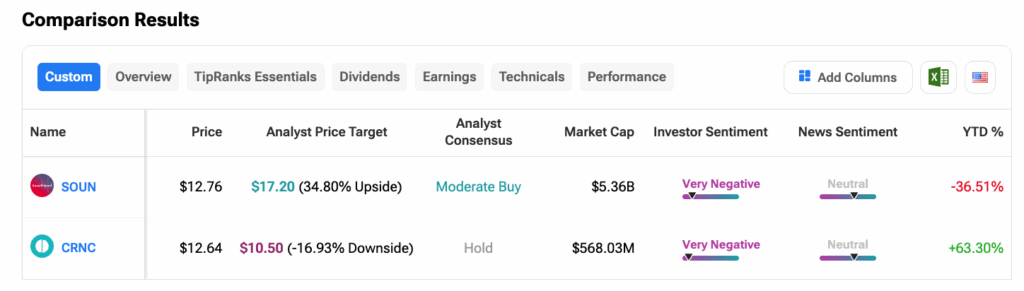

In terms of stock performance, SOUN has been highly volatile in 2025, dropping 35% year-to-date. On the other hand, CRNC shares have shown stronger stability, climbing over 60% so far this year. Let’s look at the details.

Is SOUN a Good Stock to Buy?

In Q3, SoundHound delivered a 68% year-over-year jump in its revenues. Growth was fueled by rising enterprise demand and new client additions across automotive, healthcare, finance, consumer tech, and more. The company also lifted its full-year revenue forecast to a range of $165–$180 million, slightly higher than its earlier outlook.

SoundHound is still unprofitable, but its accelerating revenue and improved guidance point to strong long-term promise.

Along with financial losses, SoundHound is facing competition in the voice AI market, where major players like Amazon’s (AMZN) Alexa, Alphabet’s Google (GOOGL) Assistant, and Apple’s (AAPL) Siri continue to pour heavy investments into their ecosystems. Even so, SoundHound differentiates itself with Houndify, a versatile and customizable voice AI platform that allows businesses to build tailored voice solutions. Its flexibility makes it especially attractive to companies looking to scale voice technology independently, without being locked into the large consumer-focused platforms of Big Tech.

Is Cerence Stock a Good Buy?

Unlike SoundHound, Cerence is a larger and profitable company, but its revenue growth is more modest and stable. While SoundHound targets many industries, Cerence is focusing almost entirely on cars, leaning on its long history in automotive software.

For FY25, Cerence posted Q4 revenue of $60.6 million and full-year revenue of $251.8 million, both beating the top of its earlier forecast. The company also issued its first FY26 revenue outlook of $300 million to $320 million, pointing to steady growth, with the midpoint reflecting a 23% increase compared to the prior year.

The highlight of Cerence’s progress is its xUI platform, a new automotive AI assistant built on advanced language models that combines voice commands, emotion sensing, and smart in-the-moment reasoning. The xUI system is designed to work smoothly with both carmaker-controlled features and online AI services, giving automakers a way to use powerful cloud-based AI without giving up control.

In July 2025, Cerence reached a major milestone by teaming up with LG Electronics to add its text-to-speech technology to millions of smart TVs, marking a meaningful step outside of the auto sector and helping broaden its revenue streams. The company also expanded projects with major automakers, underlining strong momentum in the automotive space.

SOUN or CRNC: Which Stock Offers Higher Upside, According to Analysts?

On Wall Street, SoundHound’s stock holds a Moderate Buy rating, with an average price target of $17.20, suggesting over 34% upside.

On the other hand, CRNC stock has a Hold consensus based on two Hold ratings in the past three months. Meanwhile, Cerence’s average price target of $10.50 implies a downside of 17%.

Conclusion

SoundHound is a rapidly growing company, boosting sales by bringing voice AI to many industries. SOUN could still attract investors who like long-term, high-growth potential—although stock volatility is a concern.

On the other hand, Cerence offers more stability and already earns profits, supported by its strong position in the automotive market, but its growth has been slower due to fewer chances to expand into new markets.

On Wall Street, analysts currently see stronger upside in SOUN shares, with forecasts pointing to roughly 45% potential gains ahead for investors.