SoundHound AI (SOUN) stock declined in after-hours trading today despite reporting strong third-quarter results. Also, the voice AI company raised its 2025 revenue outlook, citing strong pipeline visibility and continued enterprise traction.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company delivered Q3 revenue of $42 million, up 68% year-over-year, driven by rising enterprise adoption and new customer wins across automotive, healthcare, financial services, and consumer sectors. The top-line also easily surpassed the consensus estimate of $40.5 million.

While revenue soared, SoundHound reported an adjusted net loss of $0.03 per share. However, the reported figure compared favorably with the analysts’ expectations of a $0.09 loss and improved from the prior-year loss of $0.04.

CFO Nitesh Sharan noted, “We continue to deliver high growth with a diverse customer base, expanding product suite, and a balance sheet that enables us to stay on the offense.”

2025 Outlook

Looking ahead, the company raised its full-year revenue forecast to between $165 million and 180 million, above its earlier estimate of $160 million to $178 million.

“We see enormous potential in the near and long-term horizon, and we’re positioning our business to take full advantage,” said CEO Keyvan Mohajer.

Is SOUN a Good Stock to Buy?

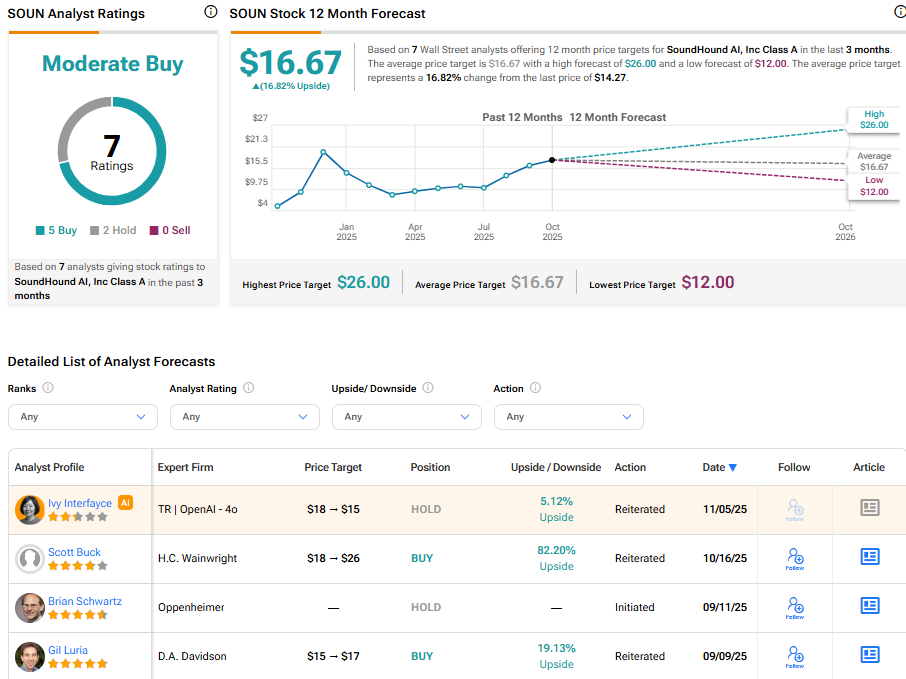

On TipRanks, SOUN stock has a Moderate Buy consensus rating, with five Buys and two Holds assigned in the last three months. The average SoundHound stock price target is $16.67, suggesting a potential upside of 16.82% from the current level.

It must be noted that analysts may update their price targets for SOUN stock after this earnings report.