Sonim Technologies (SONM) stock rocketed higher on Wednesday after the rugged mobile technology company signed a letter of intent for a reverse merger. The company hasn’t named the target for the reverse merger, but did say it’s a private U.S.-based company that’s building Nvidia (NVDA)-based AI data centers.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Here are a few quick details investors need to know about the reverse merger plan.

- Current SONM shareholders will retain equity in the combined company valued at $17.5 million.

- Shareholders of the merger target would own a majority of the combined company.

- The combined company would be valued at roughly $300 million.

- The combined company will use a new corporate name and stock ticker.

- The letter is non-binding, and the merger requires additional approvals.

- Sonim Technologies didn’t say when the merger would be completed, only that it will be in a “timely manner.”

SONM stock was up 45.54% during pre-market trading on Wednesday. That followed a 5.08% drop yesterday. Traders will also note that SONM shares are down 64.56% year-to-date and 89.23% over the past 12 months.

Is Sonim Technologies Stock a Buy, Sell, or Hold?

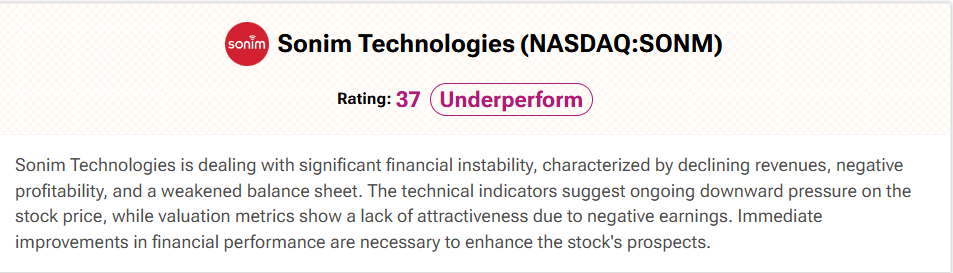

Wall Street’s coverage of Sonim Technologies is limited. Fortunately, Spark, TipRanks’ AI analyst, has it covered. It rates SONM stock an Underperform (37) with no price target. Spark cites significant financial instability, declining revenues, negative profitability, and a weakened balance sheet as reasons for this rating.