SolarBank Corporation (SUUN) is trending today after announcing plans for an expansion. The Canadian renewable energy company confirmed it will launch a 7.2 MW DC ground-mount solar panel project in Wyoming County, New York, which will feed energy directly into the local electrical grid.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Although this news hasn’t impacted SUUN stock yet, it highlights the company’s focus on expanding into new markets.

What’s Happening With SolarBank Stock?

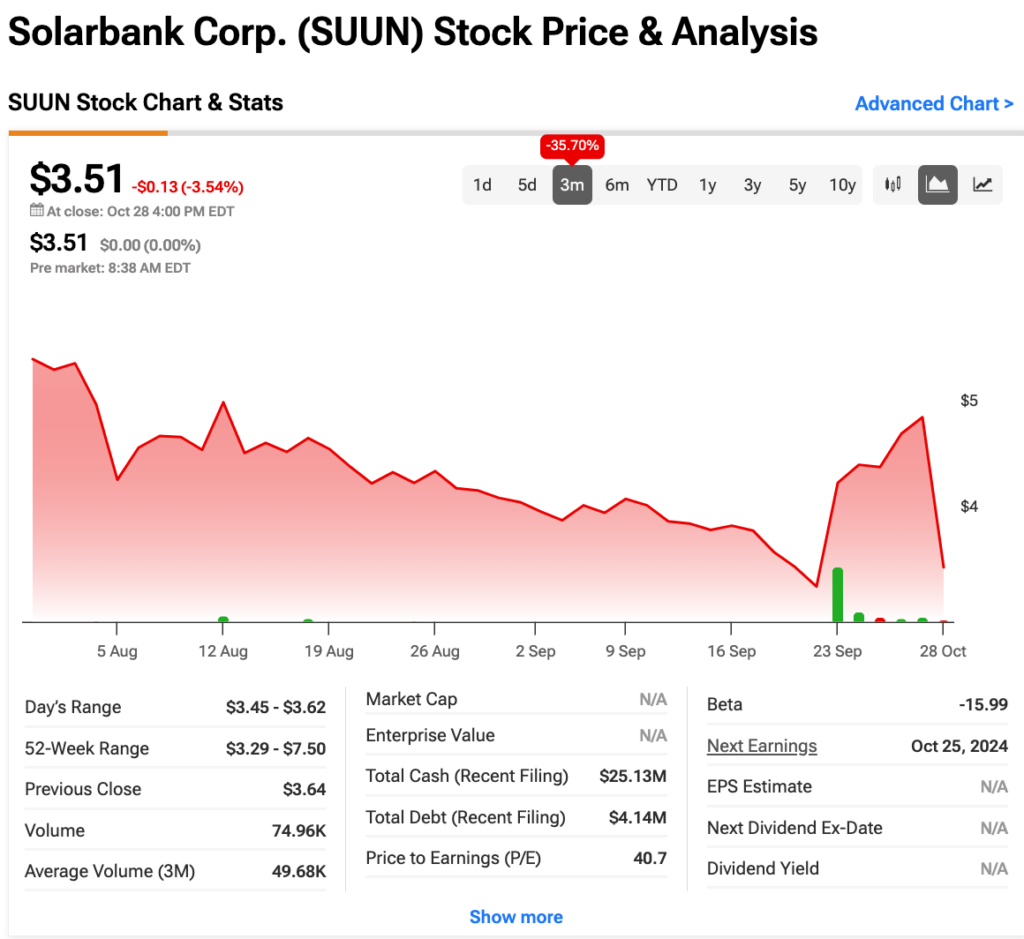

So far today, trading has been highly volatile for SolarBank stock. As of this writing, shares are down 2%. This turbulent pattern makes it hard to predict where SUUN stock will go from here until market conditions stabilize. Shares have struggled considerably over the past three months, declining 36%.

However, news of projects like this shows that the company is taking key steps to expand, making it a stock to watch for future growth in the booming solar energy market. SolarBank has also announced multiple other projects along these lines in just the past few months, such as a 7 MW DC ground-mount in Lancaster County, PA and a 3.7 MW DC solar power project in Seneca County, New York.

In a statement released today, SunBank discussed the potential implications of this new project, stating, “Depending on the size and number of panels a community solar project has, renters and homeowners can earn credits on their electric bill and save money from the electricity that is generated by a project.”

Is SunBank a Buy, Sell or Hold?

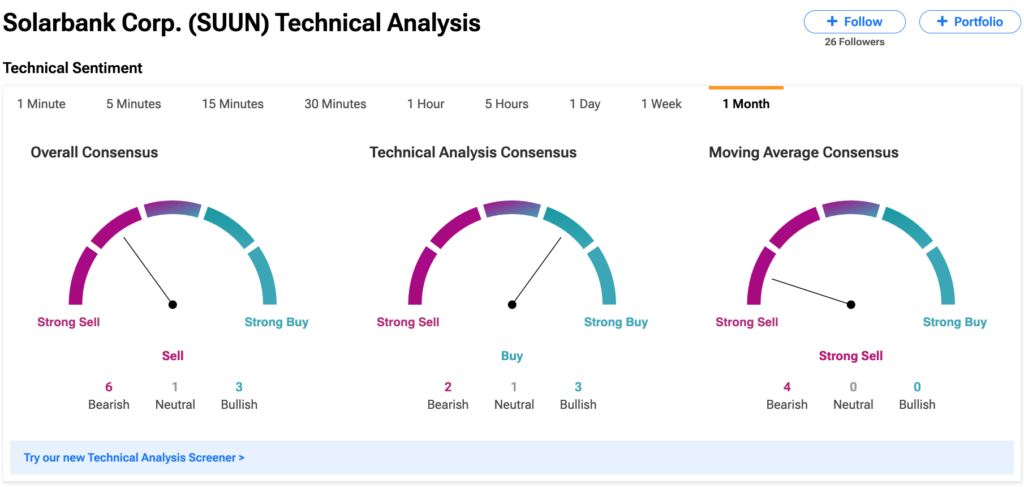

Wall Street hasn’t issued any recent ratings or price targets for SolarBank, likely due to its status as a penny stock. As such, it’s difficult to assess what rating experts believe it deserves. That said, TipRanks’ Technical Analysis tool provides some insight into SUUN, as shown in the graphic below.

This indicates that the overall consensus over the past month is that SolarBank is a Strong Sell, as is the Moving Average Consensus. Meanwhile, the Technical Analysis Consensus rates it as a Buy. However, this may change if shares rise while the company continues its expansion efforts and establishes itself as a reliable solar energy provider in the U.S.