Japanese conglomerate SoftBank Group (SFTBF) may be nearing another major AI-linked bet. The company is in advanced talks to acquire DigitalBridge Group (DBRG), a U.S.-listed investment firm focused on data centers and digital infrastructure, Bloomberg reported.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While a final deal has not yet been signed, the move reflects SoftBank CEO Masayoshi Son’s renewed push to place SoftBank at the center of the AI infrastructure buildout.

Why DigitalBridge Fits SoftBank’s AI Strategy

DigitalBridge specializes in owning and operating assets that support the digital economy, with a strong focus on data centers. The firm had about $108 billion in assets under management at the end of September. Its portfolio includes operators such as Vantage Data Centers, Switch, DataBank, AtlasEdge, and Yondr Group.

The potential deal aligns with SoftBank’s growing focus on AI infrastructure. Demand for computing power is rising as AI models become bigger and more complex. This shift is making data centers a key part of the next growth cycle. Buying DigitalBridge would give SoftBank direct access to large data center assets and the teams that manage them.

The news lifted DigitalBridge shares by 45% on the day Bloomberg first reported the talks earlier this month. The company now has a market value of about $2.6 billion, with an enterprise value near $1.73 billion.

SoftBank Ramps Up Its AI Infrastructure Push

The potential deal aligns with SoftBank’s push into infrastructure and asset management. In 2017, the company bought Fortress Investment Group for more than $3 billion before selling its stake in a deal completed in 2024.

More recently, SoftBank announced Stargate, a $500 billion data center plan alongside OpenAI (PC:OPAIQ), Oracle (ORCL), and Abu Dhabi-backed MGX. While progress has been slower than first expected, the project calls for several large sites across the U.S. to supply the computing power needed for advanced AI.

If completed, a DigitalBridge deal would mark another step in SoftBank’s effort to move beyond venture-style bets and toward owning the physical assets that power AI.

Which AI Stock Is the Better Buy?

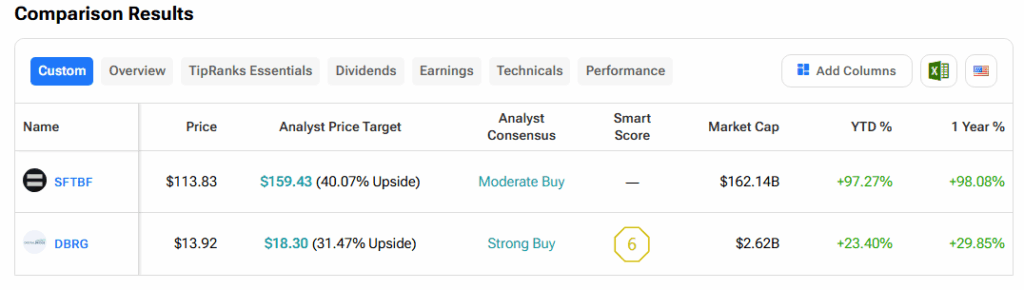

We use the TipRanks Stock Comparison tool to see how Wall Street analysts are rating SoftBank and DigitalBridge, and which company they believe has the strongest upside.