SoftBank Group (SFTBY) is making another big move in artificial intelligence, announcing a $6.5 billion acquisition of Ampere Computing, a U.S.-based chipmaker specializing in energy-efficient processors for cloud and AI computing.

The deal, announced late Wednesday, highlights SoftBank’s aggressive push into AI infrastructure at a time when the demand for high-performance computing is surging. However, this acquisition also comes with risks as Ampere has been struggling financially, posting operating losses and carrying more liabilities than assets.

And what is SoftBank’s strategy seem to be? Buy now, bet on the AI future, and build an empire that controls the backbone of next-generation computing.

SoftBank’s AI Vision

SoftBank’s CEO, Masayoshi Son, has long championed the idea that AI will surpass human intelligence. However, to achieve this, AI models need exponentially more computing power. That’s where Ampere comes in.

The California-based company specializes in low-power, high-performance chips designed for AI workloads and cloud computing. Unlike traditional processors, Ampere’s technology prioritizes energy efficiency, a crucial factor as AI data centers grow in scale and power consumption skyrockets.

SoftBank says the acquisition complements its existing chip holdings, particularly Arm Holdings (ARM), the British semiconductor firm it owns. Arm’s designs are already embedded in billions of devices worldwide, and now, with Ampere’s AI-driven chips, SoftBank is expanding its foothold in the race to dominate AI hardware.

The Financial Gamble

Despite Ampere’s expertise, the company is far from profitable. In recent years, it has posted declining revenue and growing losses, raising questions about the timing of SoftBank’s investment.

To finance the acquisition, SoftBank plans to borrow from Mizuho Bank and other lenders, spreading out the financial risk. Meanwhile, Ampere’s major investors, Carlyle Group and Oracle (ORCL), will fully exit their stakes, while SoftBank will take complete control, turning Ampere into a wholly owned subsidiary.

SoftBank’s Expanding Its AI Empire

This acquisition is just one piece of SoftBank’s broader strategy. Over the past year, the company has been aggressively investing in AI-driven ventures, including:

- Arm Holdings – SoftBank’s flagship chip subsidiary recently reported record quarterly sales fueled by AI chip demand.

- OpenAI Investment – SoftBank’s Vision Fund 2 has poured $2 billion into OpenAI, the company behind ChatGPT.

- Stargate Project – A joint venture with OpenAI, Oracle, and Abu Dhabi-based MGX to build massive AI data centers in the U.S., requiring advanced computing power.

With Ampere now in its portfolio, SoftBank is moving beyond investing in AI and working to control the infrastructure that powers it.

The deal is expected to close in the second half of 2025, pending regulatory approval. Once finalized, Ampere will retain its name and leadership and operate as a wholly owned subsidiary of SoftBank.

Will this AI gamble pay off?

SoftBank’s stock has recently struggled, with SFTBY stock down over 9% Year-To-Date, as tech shares sold off on Wall Street, hit by concerns over inflation, U.S. tariffs, and high borrowing costs. The company also reported a net loss last quarter, partly due to weakness in its tech investment funds.

Still, Masayoshi Son is pressing forward, betting that AI infrastructure will be the next big gold rush and that SoftBank will be one of its biggest winners.

Is SFTBY a Buy, Hold, or a Sell?

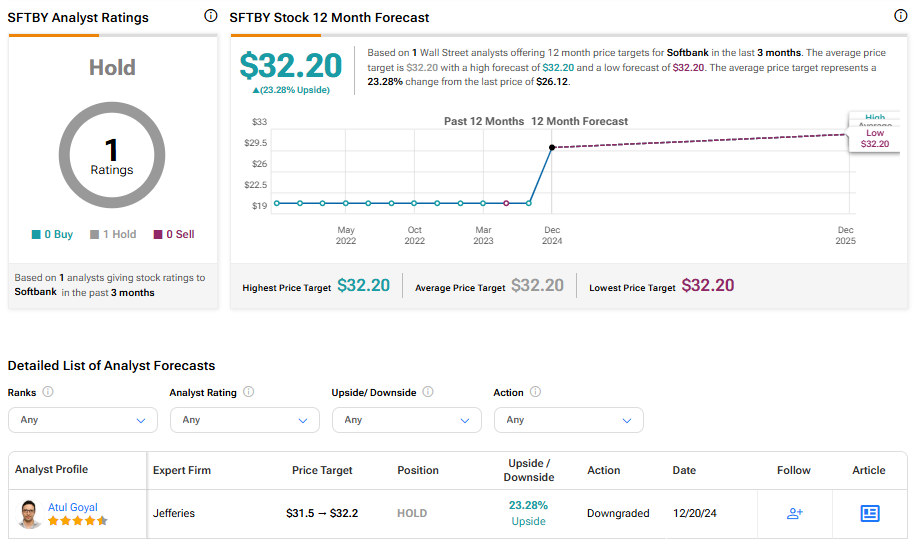

Turning to Wall Street, Softbank is a Hold. The average price target for SFTBY stock is $32.20, suggesting a 23.28% upside potential.