New reports claim that OpenAI is allowing its employees to sell $1.5 billion worth of the artificial intelligence (AI) company’s stock to Japanese investment holding company SoftBank (SFTBY). This would come in the form of a new tender offer to SoftBank, with OpenAI employees having until Dec. 24 to decide if they want to participate.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

It makes sense that SoftBank is seeking to purchase shares of OpenAI stock. CEO Masayoshi Son has invested in the AI boom, including acquiring chipmaker Graphcore. SoftBank also participated in an October funding round for OpenAI, which saw it invest $500 million in the AI company. The price of shares in this upcoming tender offer reportedly matches the prior one.

Who Else Holds Stakes in OpenAI?

OpenAI is backed by Microsoft (MSFT), the tech giant’s biggest corporate supporter. MSFT soars past other interested parties, with almost $14 billion in funds invested in the AI research organization.

Nvidia (NVDA) is another major backer of the ChatGPT creator. That makes sense, as OpenAI uses Nvidia’s graphics cards to power its AI services. In this case, Nvidia’s investment is akin to protecting a business partner.

Of course, investment firms outside Softbank have also shown interest in supporting OpenAI. In that prior round of funding, Thrive Capital made the largest contribution, investing $1.2 billion in OpenAI. Altimeter Capital, Fidelity National Financial (FNF), and MGX were among the investment firms that acquired a stake in the company then.

How to Invest In OpenAI

OpenAI stock isn’t available on the public markets right now. Instead, traders who want exposure to AI companies will have to invest in public companies that hold a stake in it.

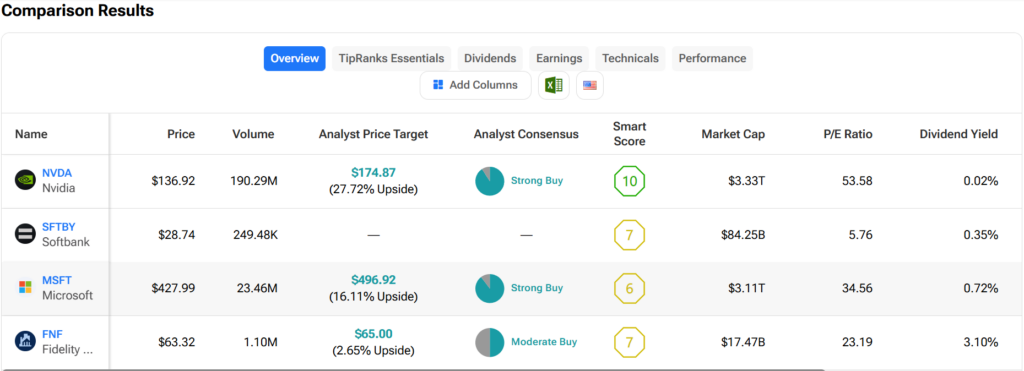

Of the companies mentioned in this article, Nvidia appears to be the best bet. It has a TipRanks’ Smart Score of 10, a consensus Strong Buy rating from analysts, and a potential 27.72% upside based on its $174.87 average price target.