SoFi Technologies (SOFI) is set to announce its Q3 2024 earnings on October 29. Wall Street analysts expect the company to report earnings per share of $0.04, a notable improvement from the $0.29 loss in the same quarter last year. Revenue is expected to reach $632 million, representing a 17% year-over-year decline, according to data from the TipRanks Forecast page.

SoFi Technologies is an online provider of a wide range of financial services, offering lending and other financial products to its members. As Q3 approaches, it’s worth noting that SoFi has exceeded consensus EPS estimates in eight of the past nine quarters.

Impressive Website Traffic Trend

Though analysts expect SOFI’s revenues to decline from the year-ago quarter, the company’s website traffic data suggests strong results for the company in the upcoming Q3 quarter. It should be noted that investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

For SOFI, TipRanks’ website traffic screener reveals that the traffic increased sequentially as well as year-over-year in Q3. According to the tool, the number of visits to sofi.com increased 67.08% from the year-ago quarter and 8.76% sequentially. This rise in visits suggests that demand for the company’s offerings remained strong during the quarter.

Key Takeaways from TipRanks’ Bulls & Bears Tool

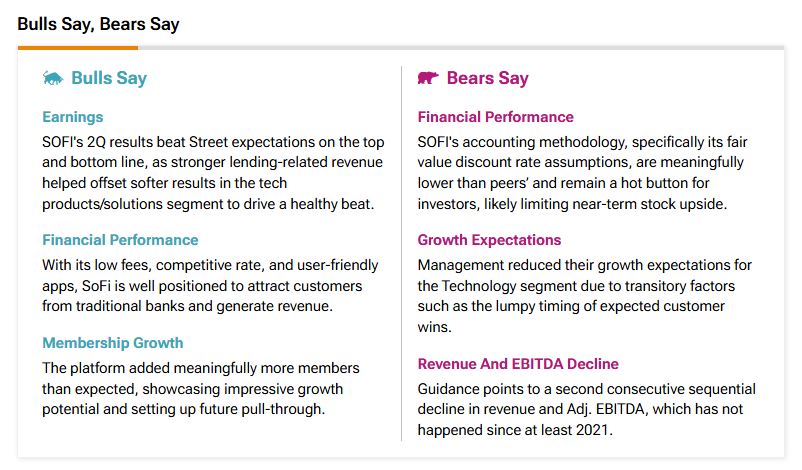

TipRanks’ Bulls Say, Bears Say tool offers insights into analysts’ perspectives on SoFi as it nears its Q3 earnings report. The bulls are optimistic, pointing out that SoFi’s second-quarter results surpassed Wall Street expectations for revenue and earnings, driven by strong lending-related revenue that offset weaker performance in tech products. With competitive rates, low fees, and user-friendly apps, SoFi is well-positioned to attract customers from traditional banks. Additionally, the analysts noted that SOFI’s platform significantly increased its membership, highlighting strong growth potential for future revenue.

On the flip side, bears noted that SOFI’s guidance suggests a second consecutive decline in revenue and adjusted EBITDA, a trend not seen since at least 2021, raising concerns among investors.

Options Traders Anticipate a Large Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting a 13.01% swing in either direction.

Is SoFi Technologies a Good Stock to Buy?

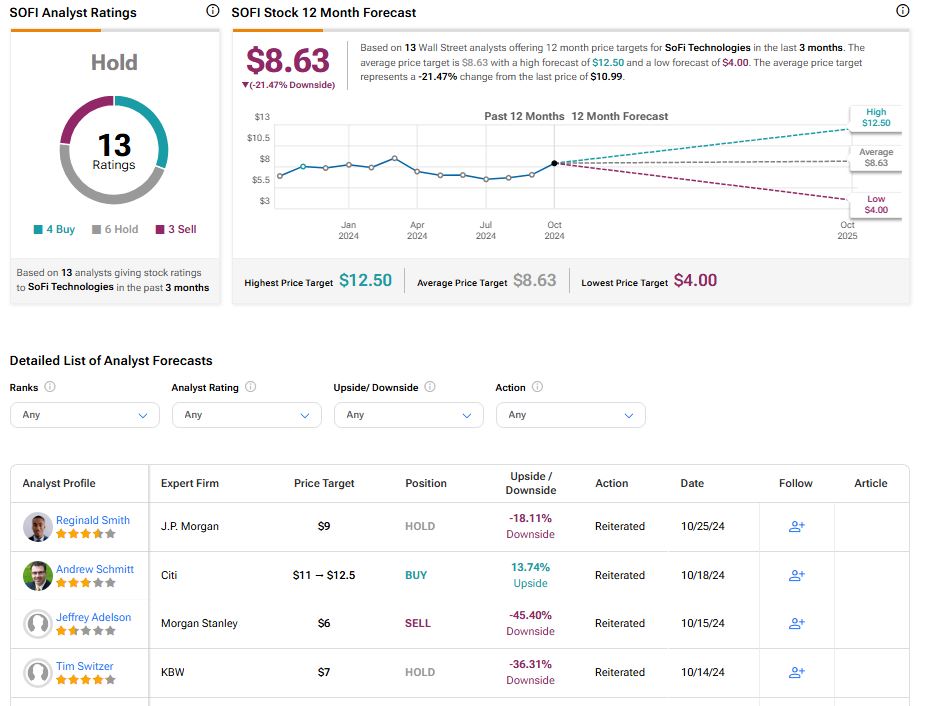

Turning to Wall Street, SoFi Technologies stock has a Hold consensus rating based on four Buy, six Hold, and three Sell ratings assigned over the last three months. At $8.63, the average SoFi Technologies stock price target implies downside potential of 21.47%. The shares of SOFI have gained 58% over the past year.