SoFi Technologies (SOFI), a financial technology company, is likely a multibagger in the making, driven by strong financial growth and in-demand consumer finance products. While the company’s stock has declined 23% this year, the drop looks like a buying opportunity given SoFi’s long-term growth potential. As such, I’m bullish on the stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SoFi’s Diversified Products

SoFi’s wide range of financial products is one reason that I am bullish on the stock. Having more financial products allows this digital bank to generate strong revenue per user. The company offers student loans, mortgages, credit cards, bank accounts, investment accounts, and other financial instruments. Lower interest rates that are expected in the U.S. should bolster demand for SoFi’s loans.

SoFi’s status as an online bank allows it to offer attractive rates to customers as it doesn’t have many of the expenses of traditional banks, such as leases on physical branches and offices. SoFi’s credit card offers unlimited 2% cashback on all purchases. It also offers a savings account with 4.50% APY, which is higher than most competing financial institutions. The bank now has 8.7 million members, and its customer base has grown 41% in the last year, fueled by the company’s competitive products.

Growing Profits at SoFi

SoFi’s profitability is another reason why I’m bullish on this stock. The company delivered 20% year-over-year revenue growth, which is strong. But profits have been exceptional. Most recently, SoFi delivered $17.4 million in net income. That’s up from a $47.5 million net loss a year earlier. The company has now been profitable for three consecutive quarters.

Moving forward, SoFi has an opportunity to expand its net profit margins from its current level of 3%. It might not be long before the company reports double-digit net profit margins. Rising profits will make SoFi’s valuation more attractive, especially if investors look out to 2025. SoFi currently trades at a 32 times future earnings estimates, which is much lower than in previous years. The earnings growth is bringing the valuation down and presents a long-term opportunity for patient investors.

A Buy-The-Dip Opportunity

The current buy-the-dip opportunity in SOFI stock is yet another reason to be bullish on this security. SoFi’s stock has underperformed the market since the company went public in late 2020. Since its initial public offering (IPO), SOFI stock has declined 28%. While the underperformance might deter some investors, I feel that the current share price of $7.46 presents a great entry point.

Plus, Sofi’s share price has risen 15% in the past month, indicating that the stock may have now bottomed. Long-term investors who have patience are likely to be rewarded for buying SOFI stock at current levels. I see light at the end of the tunnel that should result in meaningful long-term gains for shareholders.

Is SoFi Stock a Buy or Sell?

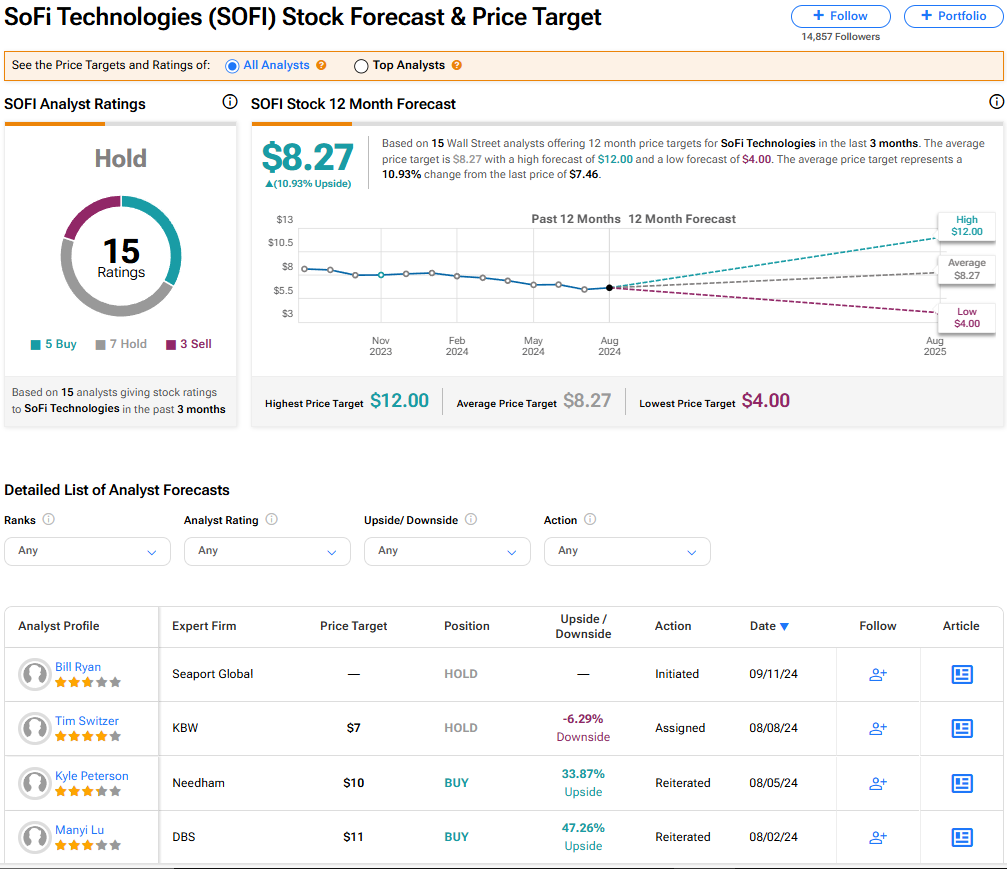

SoFi’s stock is rated a Hold among 15 analysts who track the company’s progress. There are currently five Buy, seven Hold, and three Sell ratings on the stock. However, the average price target on SOFI stock of $8.27 implies almost 11% upside from where the shares are currently trading.

Read more analyst ratings on SoFi’s stock.

Conclusion: Catalysts Are Forming on the Horizon

SoFi has trailed the stock market since its 2020 IPO, but a few catalysts forming on the horizon should boost the share price in the coming months. A growing customer base, booming profit margins, and a diversified product line can lead to long-term gains for patient investors. Up 15% in the past month, SoFi shows potential and could eventually become a multibagger stock.