SoFi Technologies (SOFI) stock plunged 10% on Thursday after witnessing a strong rally, backed by solid fundamentals in recent quarters. Despite this pullback, the stock is still up over 76% year-to-date. The digital bank and fintech company recently reported upbeat Q3 results and raised its full-year guidance as it continues to see robust expansion in its member base and increased adoption of its product offerings. However, several analysts contend that SOFI’s valuation is elevated and the optimism about its growth potential is already priced into the stock. In fact, Wall Street’s average price target for SOFI stock indicates that shares are fully priced at current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SOFI’s Member Base, Solid Execution Drive Strong Growth

SoFi Technologies’ member base continues to expand at an impressive rate, driven by the company’s product innovation. In Q3 2025, SOFI added 905,000 new members and 1.4 million new products. It ended the quarter with 12.6 million members and 18.6 million products, reflecting growth of 35% and 36%, respectively, from the prior-year quarter.

Moreover, SoFi’s focus on fee-based, high-margin revenue sources is also bolstering its position. The company highlighted that in Q3 2025, its fee-based revenue across the business grew 50% to $408.7 million, now generating more than $1.6 billion on an annualized basis. Meanwhile, SOFI’s loan business is also delivering strong performance. Total loan originations surged 57% year over year to $9.9 billion in the third quarter, with strength across personal, student, and home loans.

Wall Street Weighs in on SOFI Stock

Following the impressive print, Jefferies analyst John Hecht increased his price target for SoFi Technologies stock to $35 from $32 and reiterated a Buy rating. Hecht noted that the company’s Q3 results surpassed the Street’s estimates across most metrics, fueled by impressive loan originations, expansion of the member base, and growth in fee-based revenue.

Hecht added that SoFi’s upgraded full-year outlook indicates upside to Q4 estimates. Overall, the 5-star analyst believes that SOFI is well-positioned to deliver continued growth, with prospects in crypto, stablecoin, and student/home loan refinance amid a rate-cut environment. He highlighted that the company’s growth initiatives support its transition to a capital-light model and the “pursuit of a constructive ROE [return on equity] target.”

In contrast, Keefe Bruyette & Woods (KBW) analyst Tim Switzer maintained a Sell rating but raised his price target to $20 from $18. The analyst noted the company’s better-than-expected Q3 revenue and EBITDA (earnings before interest, taxes, depreciation, and amortization) and guidance upgrade, along with strong loan originations. Despite the Q3 beat, Switzer remains bearish on SOFI stock due to an unfavorable long-term risk/reward outlook.

Is SOFI a Good Stock to Buy?

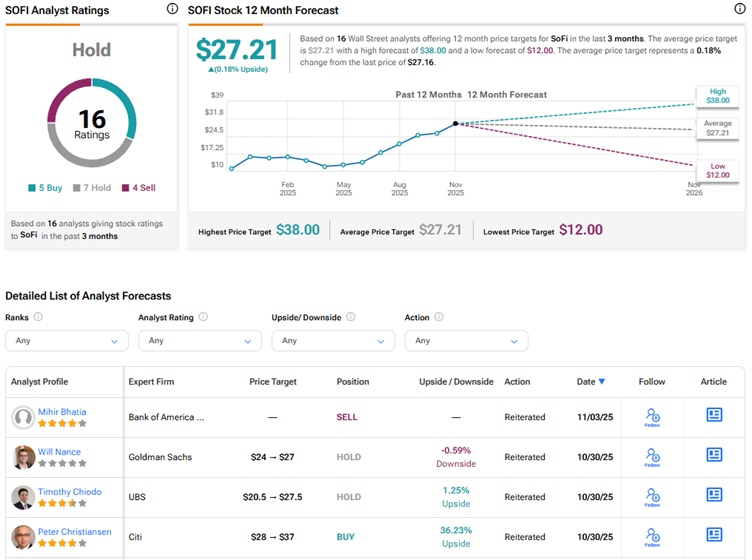

Currently, Wall Street has a Hold consensus rating on SoFi Technologies stock based on five Buys, seven Holds, and four Sell recommendations. The average SOFI stock price target of $27.21 indicates that shares are fully priced at current levels.