Shares of SoFi Technologies (SOFI) rose 3.6% on Monday, closing at $19.24, as investors continued to react to policy changes proposed by President Donald Trump. His recently unveiled tax plan includes tighter limits on federal student loans, a move that could steer more students toward private lenders like SoFi. The rally also comes just weeks before the company’s second-quarter earnings report on July 29, adding to the growing buzz around the stock. Backed by strong Q1 results and a new policy boost, SoFi continues to draw investor interest. The stock has now surged over 100% in the past three months.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Why Trump’s Tax Proposal Matters

The tax bill, passed by the Senate and now awaiting a House vote, aims to lower the cap on federal graduate loans. If approved, this would limit how much students can borrow from the government, creating a funding gap for higher education.

That gap could benefit private lenders. SoFi, known for student loans and refinancing, is well-positioned to step in. A drop in federal support could drive more borrowers to its platform, and that’s what investors are betting on. With expectations of rising loan volume, the market sees an opportunity for growth if the bill becomes law.

Earnings on the Horizon

SoFi is set to report its second-quarter results on July 29, and investor expectations are already high. After posting strong Q1 numbers, with revenue up 20% and earnings up 200% year-over-year, the market will be watching to see if the momentum continues.

Wall Street analysts expect the company to post earnings of $0.06 per share, up 500% from the year-ago quarter. However, revenues are expected to decrease by about 7% from the year-ago quarter to $801.8 million, according to data from the TipRanks Forecast page.

With student lending now in focus due to the proposed tax bill, SoFi’s performance in that segment will likely draw even closer attention this quarter. A solid report could give the stock another lift as policy tailwinds and strong business fundamentals begin to align.

Is SOFI a Good Stock to Buy?

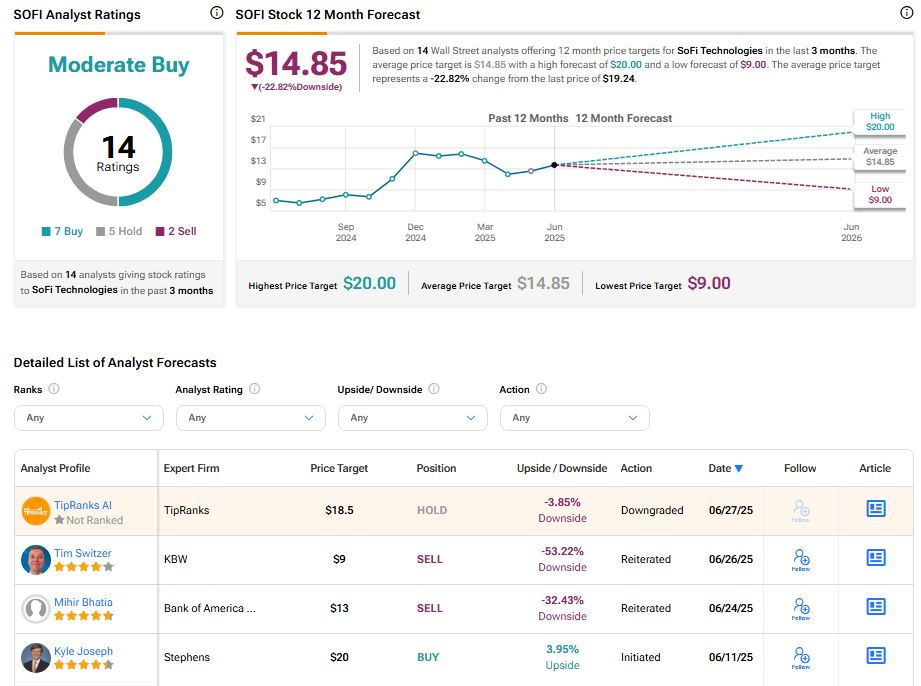

Overall, Wall Street has a Moderate Buy consensus rating on SoFi Technologies stock based on seven Buys, five Holds, and two Sell recommendations. The average SOFI stock price target of $14.85 indicates a 22.82% downside risk from current levels.