SoFi Technologies (SOFI) stock plunged more than 7% after the digital financial services platform announced a massive offering of $1.5 billion in new common shares. The announcement sent shares trading below $28, wiping out the day’s gains, despite the stock being up a massive 92% this year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The San Francisco-based fintech stated in a regulatory filing that it plans to use the net proceeds for general corporate purposes, including increasing its capital position, improving capital management, and funding new growth opportunities. However, the sheer size of the offering immediately triggered investor fears over dilution, where issuing a large amount of new stock reduces the value of existing shares.

$1.5 Billion Offering Tanks SOFI Ahead of Critical S&P 500 Decision

The announcement came at a critical time for SoFi. The company was being considered as a potential addition to the S&P 500 (SPX) benchmark index during its quarterly rebalancing this month. Analysts believed SoFi’s stock was a prime candidate based on its growth and changes in its shares outstanding. The new index additions are set to be announced on Friday afternoon.

The massive $1.5 billion share sale, however, injects significant uncertainty into the immediate stock performance and capitalization picture. Goldman Sachs (GS) is leading the underwriting for the sale, along with BofA Securities (BAC), Citigroup Global Markets (C), Deutsche Bank Securities (DB), and Mizuho Securities (MFG).

SoFi has seen spectacular performance over the past year, with its stock rising 89% over the last 12 months. The decision to raise such a large amount of cash via equity, despite the high trading price, suggests an aggressive move to capitalize on its high valuation and prepare for future expansion.

Is SoFi Stock a Good Buy?

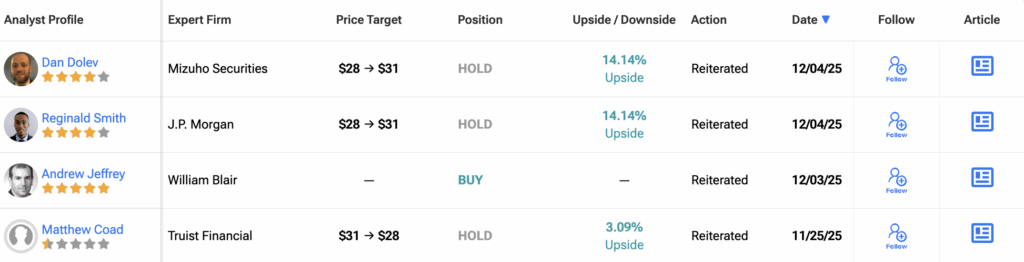

Analyst sentiment toward SoFi Technologies (SOFI) is rated as a Hold, based on the consensus of 16 Wall Street analysts tracked in the last three months. Of these ratings, four analysts call it a Buy, eight recommend a Hold, and four recommend a Sell.

The average 12-month SOFI price target sits at $26.96. This target implies a slight downside potential of 0.74% from the last price.