SoFi Technologies (SOFI), the fintech and digital banking firm, has climbed roughly 5.8% since posting its Q1 2025 results on April 29. The rally was fueled by upbeat guidance for the full year. Management now expects EPS of $0.27 to $0.28, above both its prior range and Wall Street’s forecast, and revenue between $3.235 billion and $3.31 billion. Still, concerns over the stock’s premium valuation linger. With these positive updates in focus, let’s take a closer look at SOFI’s ownership structure using TipRanks’ Ownership tools.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

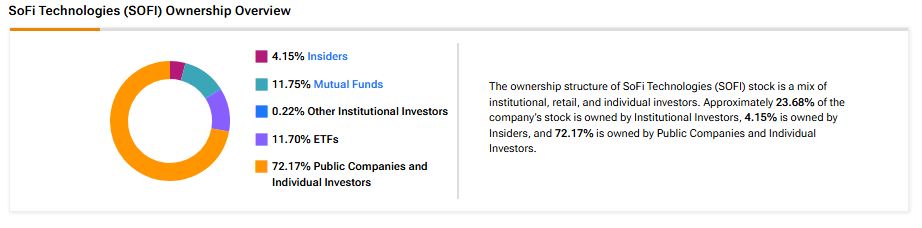

Now, according to TipRanks’ ownership page, public companies and individual investors own 72.17% of SOFI. They are followed by mutual funds, ETFs, insiders, and other institutional investors at 11.75%, 11.70%, 4.15%, and 0.22%, respectively.

Digging Deeper into SOFI’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in SOFI at 8.49%. Next up is Vanguard Index Funds, which holds a 8.20% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.96% stake in SoFi Technologies stock, followed by the Vanguard Small-Cap ETF (VB) with a 2.39% stake.

Moving to Mutual funds, Vanguard Index Funds holds about 8.20% of SOFI. Meanwhile, Fidelity Concord Street Trust owns 0.98% of the stock.

Is SOFI Stock a Buy, Sell, or Hold?

Overall, Wall Street is sidelined on SOFI stock, with a Hold consensus rating based on six Buys, five Holds, and three Sell recommendations. The average SOFI stock price target of $14.05 implies 0.07% upside risk from current levels.

Conclusion

TipRanks’ Ownership Tab provides valuable insights into the category-wise ownership structure of the company, enabling investors to make well-informed investment decisions.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue