This article was written by Shalu Saraf and reviewed by Gilan Miller-Gertz.

SoFi Technologies (SOFI) shares jumped about 6.6% on Monday, as investor interest picked up ahead of the company’s Q4 2025 earnings report, which is scheduled for Friday, January 30, 2026. The move was driven mainly by strong options activity, pointing to growing short-term optimism around the stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Call Activity Spikes Ahead of Earnings

Options traders showed clear bullish interest in SoFi. Call volume reached more than three times normal levels, with over 104,000 call contracts traded. At the same time, implied volatility moved higher, showing traders expect a bigger price move.

The most active trades were short-dated call options expiring January 9, especially at the $28 and $29 strike prices. The put-to-call ratio stood at 0.31, which suggests traders were betting far more on upside than downside.

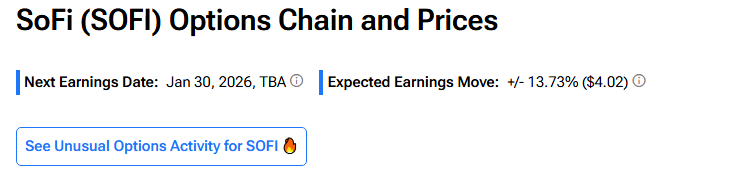

The options activity shows that traders expect the stock to move higher when earnings are released. Using TipRanks’ Options tool, we can see that options traders are expecting about a 13.73% move in either direction in SoFi Technologies stock in reaction to Q4 results.

What Investors Are Watching Next

SoFi shares had already delivered strong gains in 2025, with the stock up 91.5% over the past year. However, Wall Street expects Q4 revenue to slip about 3% to roughly $978.58 million. Earnings are also seen easing, with EPS forecast at $0.11, down from $0.29 in the same quarter last year.

Investors will be watching for updates on loan growth, credit quality, and guidance when the company reports its earnings later this month. For now, the surge in call buying appears to be the main reason behind the stock’s sharp move higher.

Is SOFI a Good Stock to Buy?

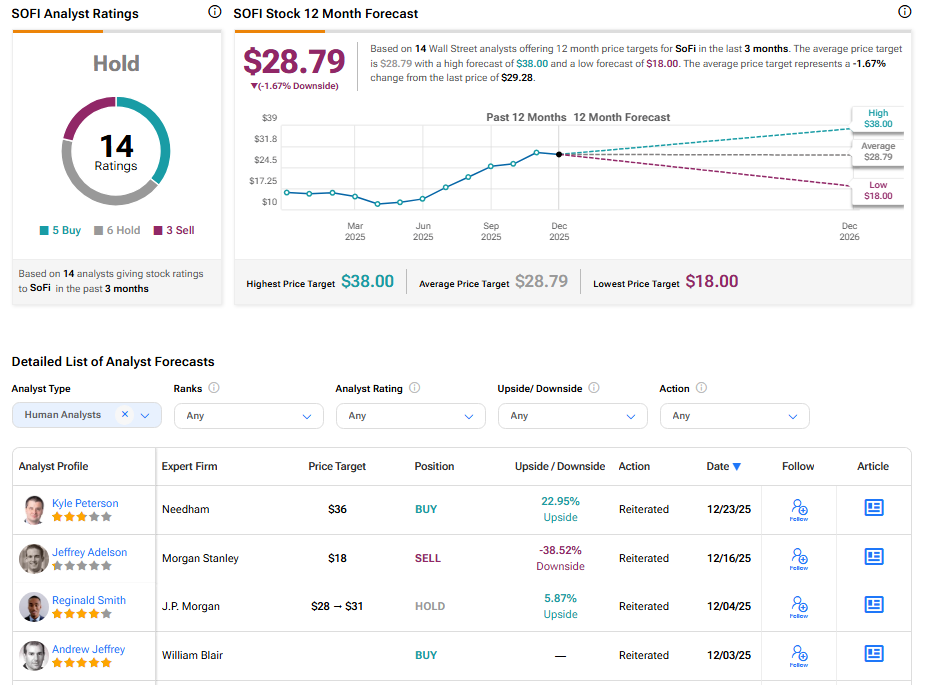

Overall, Wall Street is sidelined on SoFi Technologies stock with a Hold consensus rating based on five Buys, six Holds, and four Sell recommendations. The average SOFI stock price target of $28.79 indicates a possible downside of 1.67% from current levels.