Shares of SoFi Technologies (SOFI) gained in pre-market trading on Tuesday after the company reported robust Q3 results. The fintech company swung to a profit in the third quarter and reported earnings of $0.05 per share, slightly higher than consensus estimates of $0.04 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

SOFI’s Q3 Revenues Driven by Financial Services and Tech Platform

In a significant boost to its financial standing, the company’s adjusted revenues increased by 30% year-over-year to $689.45 million.This exceeded analysts’ expectations of $631.6 million. The stellar rise in revenues was driven by the company’s financial services and tech platform segments.

Emphasizing this growth, Anthony Noto, CEO of SoFi Technologies, commented that its financial services and tech platform segments “now make up a record 49% of SoFi’s adjusted net revenue, up from 39% a year ago. In the third quarter, these businesses grew revenue by a combined 64% year-over-year, a testament of our continued execution and deliberate shift towards capital-light, higher ROE [return on equity], fee based revenue streams.”

In addition to impressive revenue figures, SoFi added over 756,000 new members in the third quarter, contributing to a total membership growth of 35% year-over-year, reaching nearly 9.4 million.

SOFI Raises Guidance

Looking ahead, management now expects adjusted net revenues in the range of $2.54 billion to $2.55 billion, higher than its prior guidance between $2.43 and $2.47 billion. In addition, adjusted earnings are forecasted to be in the range of $0.11 to $0.12 per share, above its prior guidance between $0.09 and $0.10. For reference, analysts were expecting earnings of $0.10 per share on revenues of $2.46 billion.

Moreover, the company aims to add at least 2.3 million new members in 2024, reflecting a substantial increase of 30% year-over-year.

Is SoFi Stock a Buy?

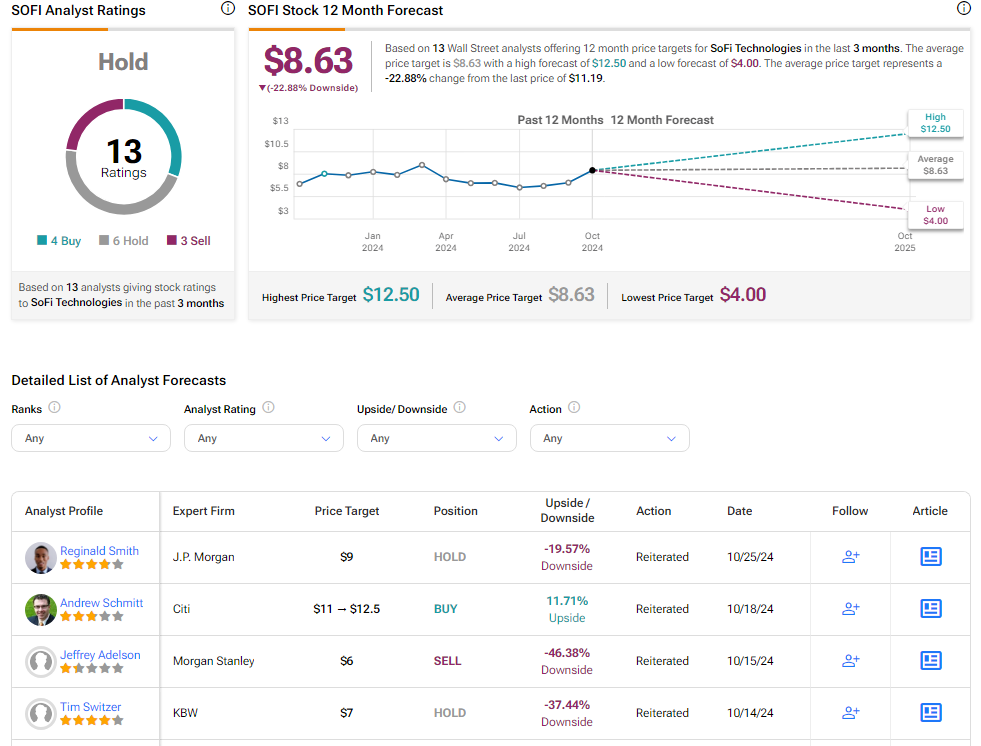

Analysts remain sidelined about SOFI stock, with a Hold consensus rating based on four Buys, six Holds, and three Sells. Over the past year, SOFI has surged by more than 60%, and the average SOFI price target of $8.63 implies a downside potential of 22.8% from current levels. These analyst ratings are likely to change following SOFI’s results today.