Electric vehicle giant Tesla (TSLA) has come out with some exciting options, and some that are more head-scratchers than anything else. The Cybertruck probably falls in the latter category. From its heartbreaking—and glass-breaking—introduction to the latest word about slumping sales, it has been a bit of a disappointment. But investors seem all right with the news, and the rest of Tesla, as shares were up modestly in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla sales took a turn back up recently, reports noted, thanks to the last gasp of federal electric vehicle tax credits, which gave Model 3 and Model Y a boost. But even the last bits of tax credit programs were not enough to give the Cybertruck much of a leg up, as Tesla sold just 5,385 of them in the third quarter. That is down, reports noted, 63% against the same time in 2024. In fact, Tesla sold over 14,000 Cybertrucks in 2024’s third quarter. So far, Tesla has sold just over 16,000 for all of 2025.

Worse yet, reports suggest that Elon Musk is augmenting Cybertruck sales numbers by delivering unsold models to SpaceX and xAI, the private companies he also owns. Basically, this means Elon Musk is selling Cybertrucks to himself.

Robotaxi Expansion

But, in better news, the robotaxi project appears to be rolling along, and Tesla has plans to roll out an expansion in Colorado and in Illinois. New job postings for Autopilot operators—the folks ready to step in and take over should the robotaxi system falter—suggest that the expansions are coming once the positions can be filled.

If Tesla does manage to launch into these areas, it will be a major test featuring one key feature not seen in its tests in Austin and the Bay Area: winter roads. Robotaxis trying to pull off driving in, say, Denver or Chicago during January could be a major demonstration of how well the concept can work. Or it could be an invitation to disaster. Only time will tell which it is, but if it works, it will be a huge statement.

Is Tesla a Buy, Hold or Sell?

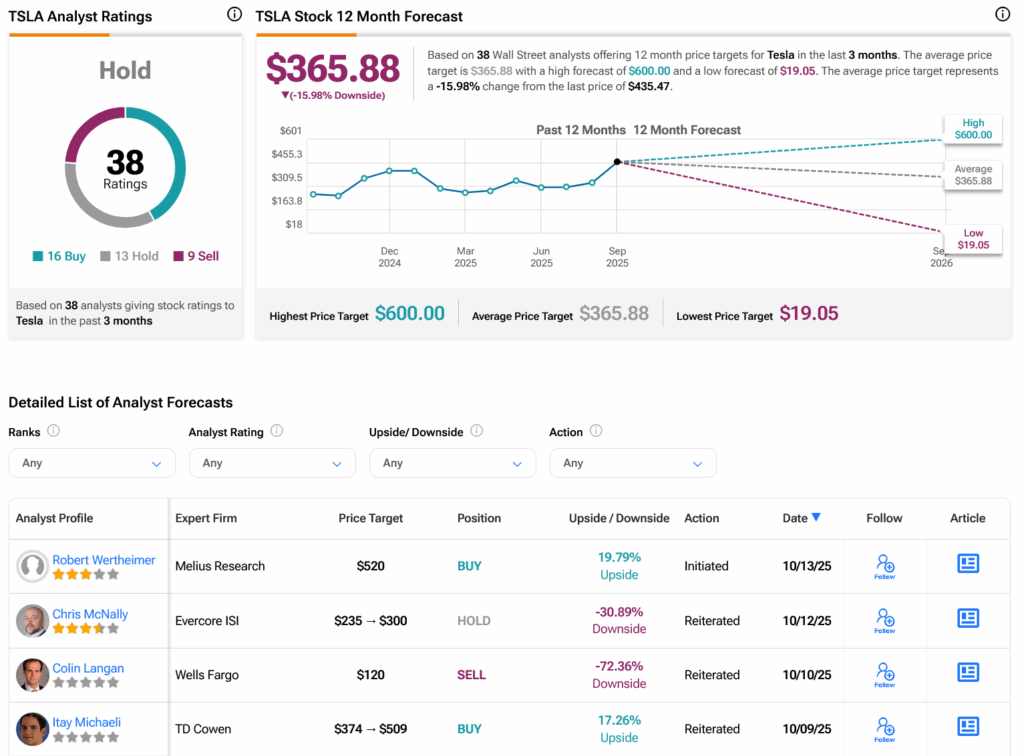

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 16 Buys, 13 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. After a 93.94% rally in its share price over the past year, the average TSLA price target of $329.77 per share implies 15.98% downside risk.